“The underlying principles of sound investment should not alter from decade to decade, but the application of these principles must be adapted to significant changes in the financial mechanisms and climate.” – Benjamin Graham

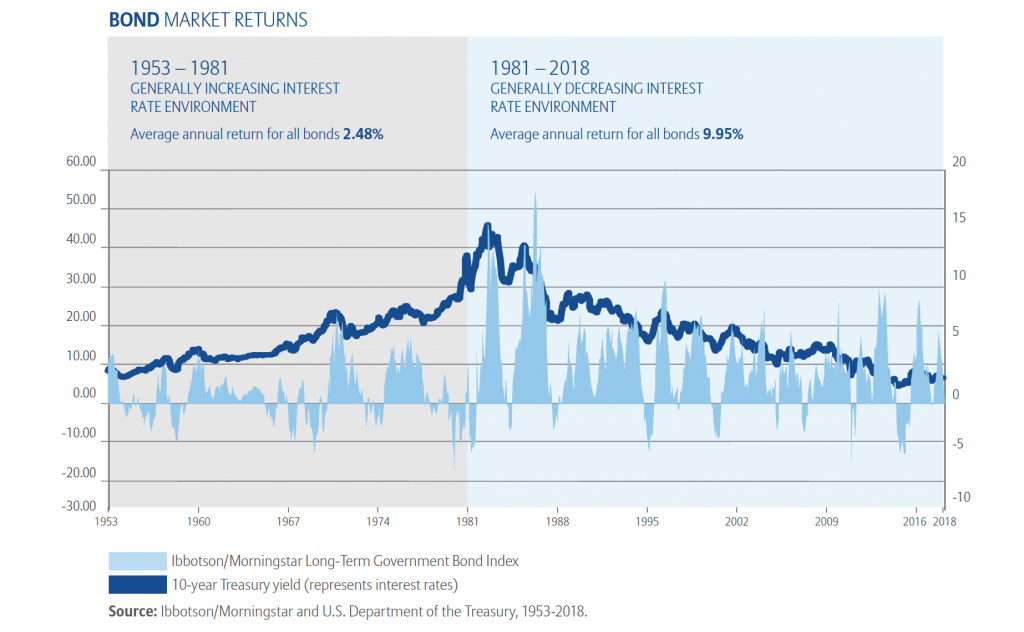

Contrary to what the talking heads discuss on a daily basis, there are rarely significant changes to the underlying principles of sound investment that are tried and true over the last 70 years. However, we are at the end of a four-decade long bond bull market which will force investors to alter the application of these principles based on the current market climate.

One of the tried and true principles is diversification with stocks and bonds. Although the long-term return of bonds is historically less than stocks, bonds generally hold their value better during market turbulence. Therefore, investors have traditionally held a portfolio of stocks and bonds to decrease the volatility of the portfolio. This principal has and will not change, but the way it is applied to portfolios may need to change based on the current low interest rate environment.

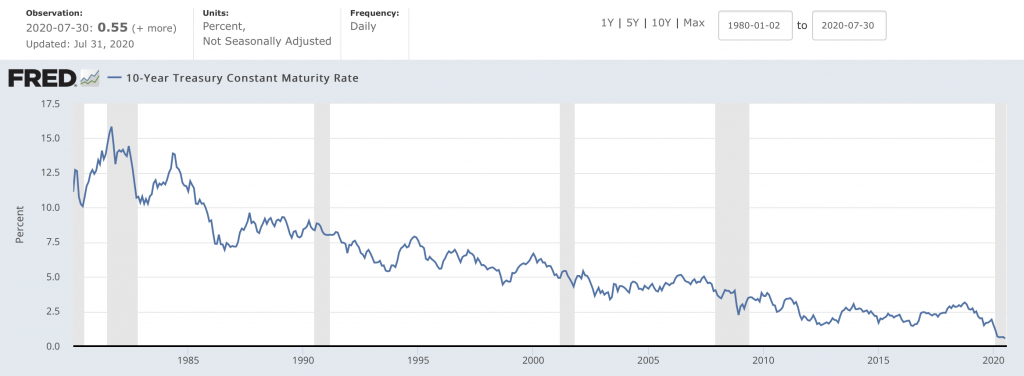

In response to COVID-19, the Federal Reserve reduced interest rates to a target range of 0.00 – 0.25%, shifting the entire yield curve down. The yield on the 10-year Treasury note is hovering around 0.6% and the 30-year Treasury bond is near 1.2%. Investment grade corporate bond yields are only marginally higher.

After nearly 40 years of interest rate decreases, there is very little capital appreciation potential left in bonds. Inflation is currently higher than the returns available on most bonds which means that the safety portion of a diversified female celebrities wearing fake Richard Mille watches portfolio is actually becoming a source of loss. If safety equals a loss, how safe is it? Is knowing and understanding the annual loss what we now consider safe?

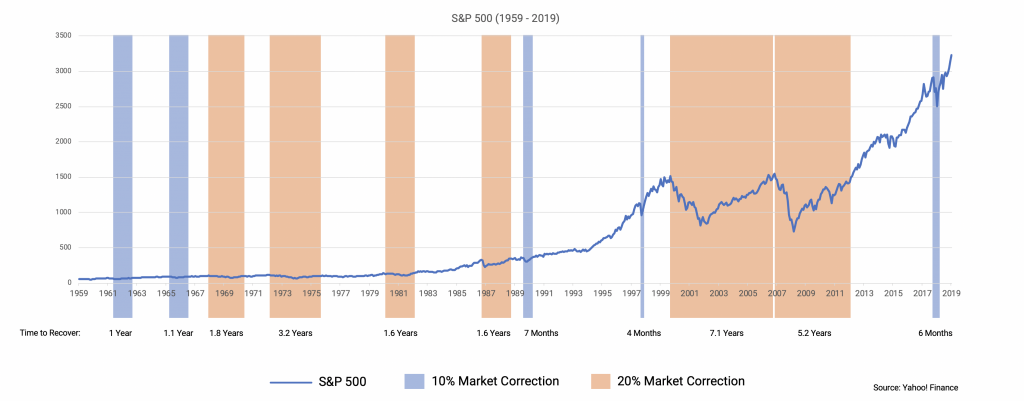

Stocks have a higher long-term average return than bonds but are substantially more volatile. After a decade of muted volatility, 2020 came back to remind us that investing in equities is not a guaranteed thing. Risk means that principle loss is possible and will always be part of equity investing.

It is also important to remember that the return on equities is comprised of two components, capital appreciation and dividends. Although capital appreciation is unreliable over a short period, the dividend yield has stayed surprisingly consistent. At the present time, the yield of the S&P 500 Index is 1.93%1. This is higher than most investment grade bonds, and unlike the current bond market, there is a realistic opportunity for capital appreciation. Investors must reassess if bonds are really safer than stocks if all risks are considered.

All investors need to review the application of a diversified portfolio based on the low interest rate environment that will likely persist over the next decade. This does not mean that diversification should be abandoned but most investors may need to accept that additional equity risk will be needed to achieve the target return necessary to achieve their goals.

The traditional methods of diversified portfolio construction, such as a 60% stock and 40% bond allocation, needs to be challenged. Investors should consider holding 4-6 years of safety, or the Lifestyle Capital needed to satisfy all possible income and capital needs in bonds, as opposed to the percentage approach. The remaining portion should be invested in equities. This could allow stocks to stay invested over almost all historic economic cycles which minimizes the risk of needing to sell during an inopportune time.

Utilizing this Lifestyle Capital approach as opposed to the traditional percentage approach will reduce the return drag of holding fixed income over a very long period and would improve portfolio efficiency. For some investors, this would mean increasing equity risk above what is currently being taken.

Over the last 6 months, increased risk in all aspects of life have become the norm. The low interest rate environment will be the new norm so investors must adapt to it, much like everyone has adapted to the current COVID-19 pandemic. The new safety paradox that all investors must consider is that increasing equity holdings may, in fact, decrease the long-term risks that affect portfolios.

1 S&P500 Dividend Yield, June 30, 2020 https://ycharts.com/indicators/sp_500_dividend_yield#

Please note – investing involves risk, and past performance is no guarantee of future results. Asset allocation does not ensure a profit or protect against a loss. This material is intended for illustrative purposes only and should not be construed as specific investment or tax advice.

Investment advisory services offered through MBM Wealth Consultants, LLC, a registered investment adviser. Registration does not imply a certain level of skill or training.