by Matt Westhoff, CFP®

“Blessed are the young for they shall inherit the national debt.”

Herbert Hoover

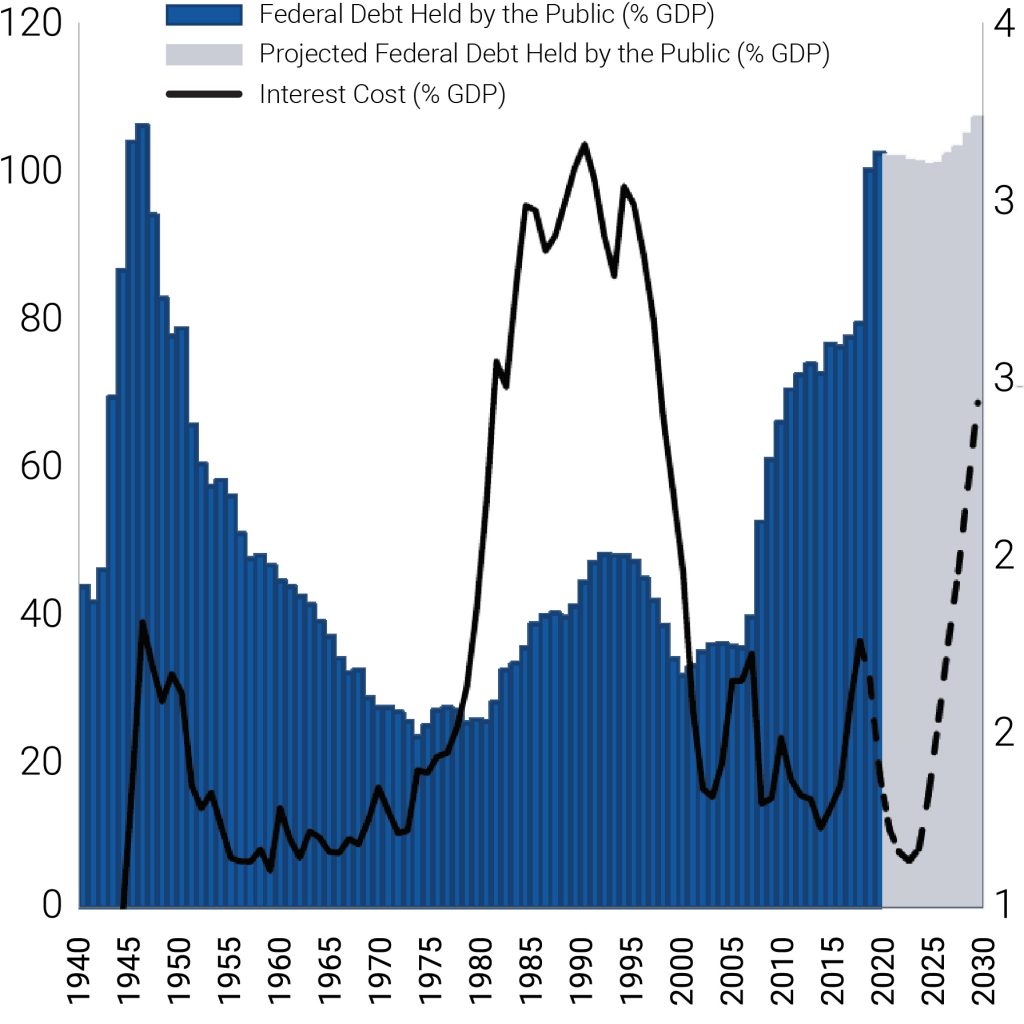

The turning point of humanity’s fight against COVID-19 started with vaccinations, and we can finally see the light at the end of the tunnel. Even though a full return to normalcy is still in the future, we have come a long way since the dark days of forced quarantine and shutdowns. The US economy was able to weather the economic storm fairly well due to its underlying strength before COVID-19 and record economic stimulus after the pandemic started. As MBM correctly predicted last spring, the economy and stock market made rapid V-shaped recoveries. However, the level of national debt ballooned from the stimulus and increased to over 100% of GDP. Many investors are asking what the effect of the current debt will be and if the stimulus has pushed assets into bubble territory.

The current level of spending is not sustainable and will need to be addressed in the near future. However, the US has been in this position before. Government debt was used to finance much of World War II and much like today, the national debt jumped to over 100% of GDP.

The exit plan will be very similar to what we saw in the 50s and 60s as the national debt steadily declined. There are two critical factors that will help bring down the debt/GDP ratio: increased tax revenue and above average economic growth.

The Trump era tax cuts are almost certain to end. President Biden has expressed his desire to increase taxes, which will help manage the debt/GDP. Although the final details of his tax plan have not been released, estimates call for an increase of $3.375 trillion increase in tax revenue. Based on the most recent tax reform proposals, the changes are expected to decrease federal debt by 6.1% and increase GDP by 0.8% by 2050. MBM Wealth Consultants recognizes this presents risk for our clients and is actively tracking the various tax discussions. As additional information is known, we will be proactively adjusting investment and tax strategies.

source: https://budgetmodel.wharton.upenn.edu/issues/2020/9/14/biden-2020-analysis

source: https://rsmus.com/what-we-do/services/tax/federal-tax/president-bidens-tax-plan.html

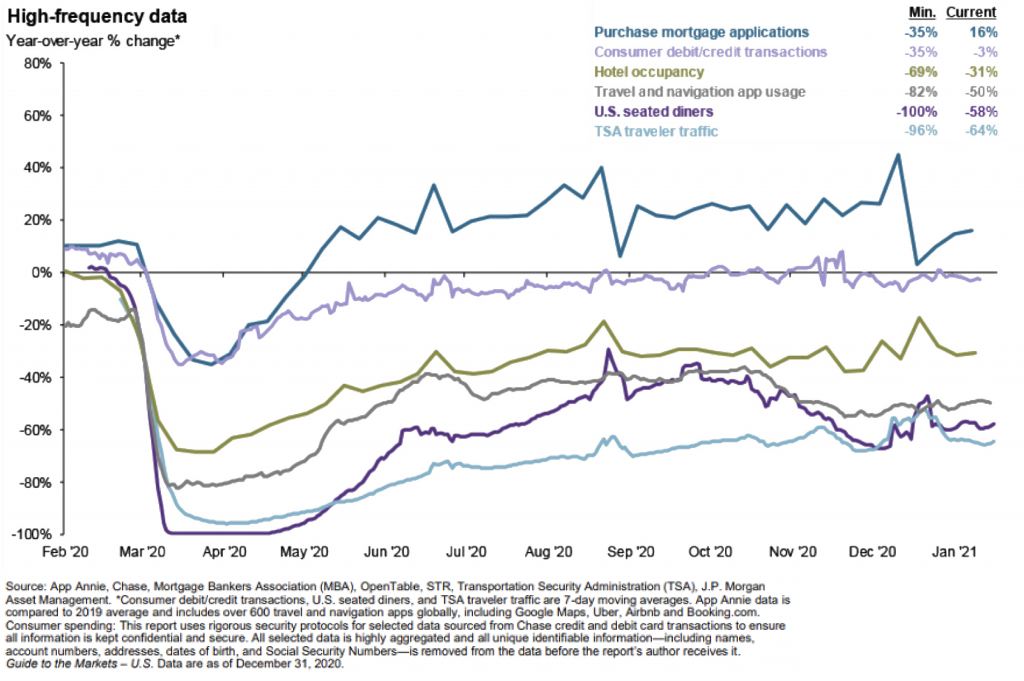

On the positive side, we believe there is pent up consumer demand that will spur above average economic growth once there is a full return to normalcy. In addition to near record bank assets and historically low consumer debt levels, high frequency data about the consumer, which accounts for about 68% of GDP, points to rapid economic expansion. Hotel occupancy, seated diners, TSA traveler traffic, and consumer credit/debit card transactions have not recovered to pre-COVID levels. As these metrics rise, the economy should see above average economic growth.

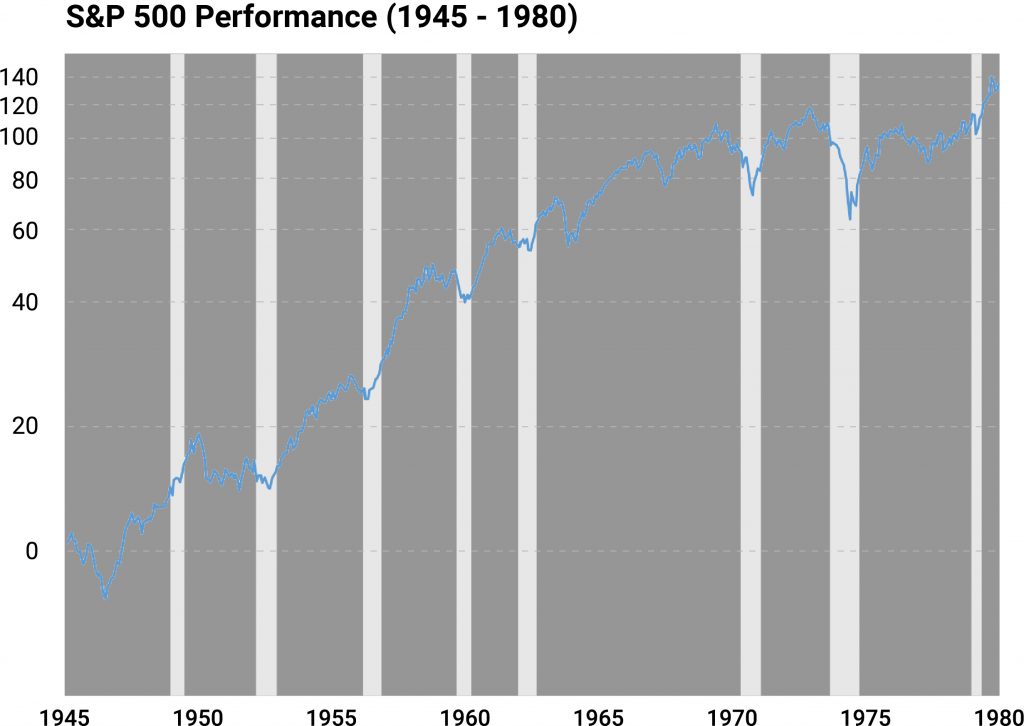

That expectation of above average growth has driven the forward P/E ratio of the S&P 500 from the high teens to low 20s. It is important to remember that stock prices are a forward-looking indicator of the economy. Although the current market valuations are not justified by the current earnings, it is the underlying belief of high future economic growth from a return to normal that is driving the market. Although this sounds scary, it is a normal part of market growth. In a healthy market environment, P/E ratios go through periods of rapid expansion and lulls which is why the growth of the market is rarely linear. It is important that earnings catch up to the valuations before additional market growth. This prevents the dreaded bubble.

Over the past two years, investors have enjoyed rapid asset appreciation. Although MBM is bullish on stocks compared to fixed income, increased volatility and smaller returns should be expected until earnings justify the current valuations. During periods of heightened risk, it is critical to continue MBM’s fundamental approach of keeping at least 4-6 years of capital needs in safety to ensure that equities don’t have to be sold during a period of volatility. Due to the low interest rate environment, holding additional safety can result in an unnecessary drag.

Over the last couple of months, many investors have expressed fear that the jump in the ratio of debt/GDP and high stock market valuations signal a market crash. However, the current economic environment is closer to what we saw in the late 1940s than the late 1990s. Although the level of debt is high on a relative basis to GDP, the cost of servicing that debt is low, making the burden much more manageable. Walking forward from 1947, we saw high tax rates and GDP growth average 3.6% until 1960. This decreased the national debt and the S&P 500 appreciated, giving us confidence that a similar story will play out.

source:https://www.multpl.com/us-real-gdp-growth-rate/table/by-year

We also know that the market will do what the market needs to do to prove the greatest number of people wrong. In this uncertain world of COVID-19 news and a change in the administration, emotions are high. Be on guard! Emotions are routinely a killer of investment returns. This is why we continue to follow strict investment fundamentals. Although the market is highly unpredictable in the short term, it is very predictable over the long term, as long as fundamentals are followed.

All of us at MBM Wealth Consultants appreciate your continued trust! We have exciting news about an investment we made in your experience that will be released in the next month.

Please note – investing involves risk, and past performance is no guarantee of future results. Asset allocation does not ensure a profit or protect against a loss. This material is intended for illustrative purposes only and should not be construed as specific investment or tax advice.

Investment advisory services offered through MBM Wealth Consultants, LLC, a registered investment adviser. Registration does not imply a certain level of skill or training.