By Paul Schulz, CFA and Matt Westhoff, CFP®

“Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man.”

Ronald Reagan

In our last market commentary (The Erosion of Cash Under the Mattress – Part 1), we reviewed the errors in how inflation is calculated and the pitfalls of holding too much cash during inflationary periods. Since our last market commentary was released, the Bureau of Labor Statistics confirmed our belief when the inflation data for April was published. The Consumer Price Index, which we contend understates true inflations for the consumer, increased 4.2%. This outpaced the forecasted rate of 3.6%.1 If the stimulus spending continues as proposed, inflation is here to stay, and investors will be best served proactively preparing for it by understanding how it affects popular asset classes.

Bonds

Bonds provide an investor with a stable stream of income and a higher degree of principal safety when compared to stocks. However, since the cash flow is set by the static interest rate of a bond when it is purchased, the purchasing power of this income will erode when inflation exceeds expectations. Inflation has a more drastic effect on long-term bonds than it does short-term bonds. Therefore, in an inflationary environment, a short-term bond ladder helps keep as much purchasing power as possible from the fixed income payments because the cash flows from a new bond issue will account for any increase in interest rates caused by inflation.

If inflation continually surpasses expectations, the Federal Reserve may raise interest rates to combat it. When interest rates rise, bond prices decrease. The principal of longer duration bonds will be more negatively affected than shorter term bonds. Therefore, long duration bond investors may be unable to sell the bond without a principal loss, which could negate the principal safety aspect of holding the bond. This strengthens the reason to keep the total duration of the portfolio short.

Simply put, bonds are not an effective inflation hedge. The purchasing power of the cash flow will be eroded, and the principal will likely decline. That is not to say fixed income does not have a place, but the total exposure should be closely monitored in accordance with an overall financial plan. To help protect the principal, MBM’s fixed income portfolio Lifestyle Capital Strategy is heavily skewed towards low-duration bonds.

Stocks

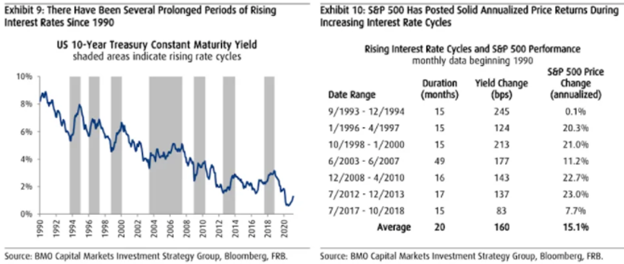

Over the last couple of weeks, there has been an uptick in volatility as many equity investors fear an increase in inflation. The theory is that when the Federal Reserve increases interest rates to combat inflation, businesses will have to borrow money at a higher cost at the expense of profitability. However, this has not always resulted in poor market performance. Since 1990, there have been seven periods of rising interest rates, and all have resulted in positive stock market performance. The average return was 15.1%.

Therefore, stocks are an efficient hedge against inflation. This is in large part due to the fact the underlying businesses of the stock market possess pricing power, meaning they can increase prices and pass on the adverse effects of inflation to the end consumer while maintaining profitability. 4

The MBM Leaders & Disruptors Strategy is heavily invested in industry-leading stocks that possess this characteristic of pricing power, which should benefit investors during periods of higher-than-average inflation.

Real Estate

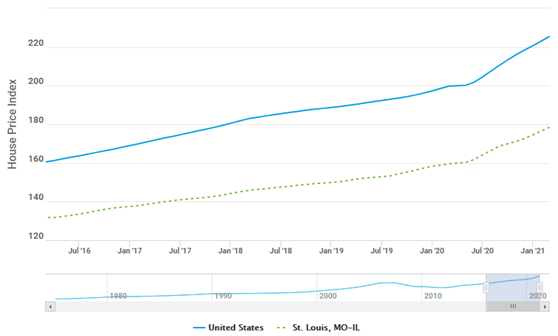

Houses are typically one of the biggest assets on an individual’s balance sheet and can often get overlooked when taking a holistic view of the impact of inflation on an individual investor. Inflation has been rapidly increasing the price of real estate.

Freddie Mac House Price Index – National Housing Statistics compared to St. Louis, MO metro area. 3

In general, hard assets like real estate provide a great hedge against inflation. As the price of the raw materials, such as lumber goes up, the price of existing houses increases.4 In addition, most homeowners have a low fixed interest rate that will likely be lower than future inflation rates. This creates an arbitrage situation where the incremental increases in the price of real estate is higher than the interest paid on the mortgage.

An inflationary environment should not be feared but negating the effect requires continual diligence. It is important to keep bond exposure in shorter duration vehicles to prevent the erosion of future cash flows and protect the principal from rising interest rates. Equity exposure should focus on companies that have lower debt loads and that can quickly pass inflationary pressure onto consumers.

1 Inflation speeds up in April as consumer prices leap 4.2%, fastest since 2008. CNBC. May 12, 2021. https://www.cnbc.com/2021/05/12/consumer-price-index-april-2021.html

2 Current US Inflation Rates: 2000-2021. US Inflation Calculator. May 28, 2021. https://www.usinflationcalculator.com/inflation/current-inflation-rates/

3 Rising interest rates are a good sign for stocks. Yahoo!. March 8, 2021. https://finance.yahoo.com/news/stock-market-implications-rising-interest-rates-morning-brief-105525383.html

4 Freddie Mac House Price Index (FMHPI) – National Housing Statistics compared to St. Louis, MO metro area. Period April 2016 to April 2021. As of June 3, 2021. http://www.freddiemac.com/research/indices/house-price-index.page

Please note – investing involves risk, and past performance is no guarantee of future results. Asset allocation does not ensure a profit or protect against a loss. This material is intended for illustrative purposes only and should not be construed as specific investment or tax advice.

Investment advisory services offered through MBM Wealth Consultants, LLC, a registered investment adviser. Registration does not imply a certain level of skill or training.