“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

Peter Lynch

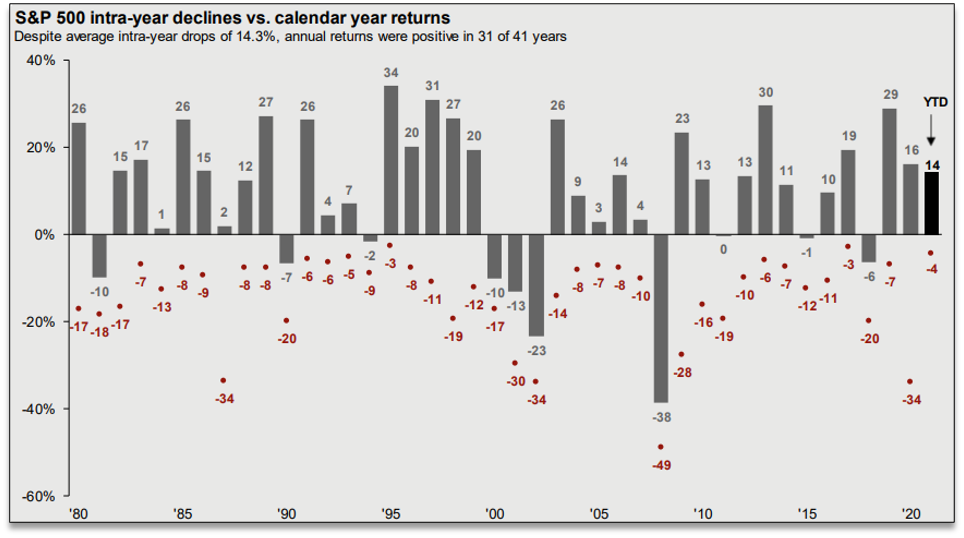

The stock market has experienced a fantastic rise with below average volatility since the low in March 2020. As of July 31st, the year-to-date return on the S&P 500 is 14%, with only a 4% drawdown. From historical perspective, a 4% intra-year drawdown for the stock market is extremely low as only 2 out the previous 40 years have had a smaller intra-year decline.

According to Yardeni Research, the S&P 500 has undergone 38 10+% corrections since 1950, averaging 1 every 1.8 years. If we use a historical perspective to estimate probabilities of a 10+% correction happening in the future, the odds of it happening increase on a monthly basis. Although no one likes to see their portfolio decrease, we believe there are several positive aspects of market corrections that can help benefit a long-term investor.

Avoidance of Bubbles

Market corrections make investors pause to re-evaluate what they are buying, why they are buying it, and what it is really worth. Without these occasional market corrections and investor sentiment checks, irrational exuberance among investors could increase the frequency and severity of bubbles. A minor 10-20% correction every couple of years is a much more favorable outcome for a long-term investor than a constant bubble and burst cycle where 40+% losses occur because the overall impact on the economy is smaller and therefore a recovery happens more quickly. Over the past 45 years, the average length of time that it has taken for the market to recover from a minor correction has been only 76 days. However, it took the market 8 years to recover from the Dot Com bubble of the 2000s and 6 years to recover from the housing bubble in 2008.

Buy Low:

For an investor that maintains a disciplined target allocation, a correction should trigger a rebalance. For example, if your portfolio target is 60% stocks and 40% bonds, a market correction will decrease the percentage held in stocks. Rebalancing back to the original target allocation forces the investor to sell what is relatively high (bonds) to purchase what is relatively low (stocks). When the market rebounds, this acts as a rubber band effect on the portfolio’s recovery because there are a higher number of shares that participates in the recovery than did in the correction.

Tax Advantages:

The focus of a non-IRA portfolio should be the highest after-tax returns for the risk taken. As positions grow at different paces, occasionally an investor will find themselves with a position that has grown into a higher percentage of the portfolio than desired. The embedded capital gains can make selling it difficult because of the effect it has on the tax plan. During a correction, some of those gains can be offset by harvesting losses in other positions which allows the investor to reposition the portfolio for the corresponding recovery without extreme taxable implications.

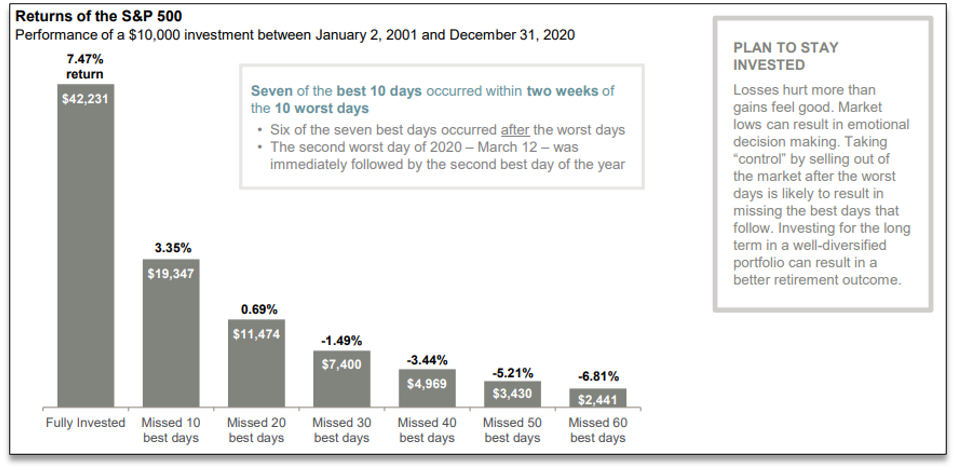

In conclusion, investors should expect and embrace market corrections as a normal and healthy part of investing. However, the best thing for most investors is to do nothing as the preparation usually causes more harm than the corrections itself. Timing the next correction is nearly impossible and no one has ever been able to consistently do it.One of the worst mistakes is trying to do so by selling out of stocks. All investors have behavioral biases that cause loss aversion so the allure of trying to do this is understandable, but historical evidence shows that missing some of the best days in the market can result in drastically reduced long term returns. Unfortunately, the best days often happen during the worst times. From 2001 to 2020, missing out on only the 10 best days would have reduced the annualized investment return from 7.47% to 3.35%. The lost return on a $500,000 investment in 2001 would be $1,030,171 in that scenario.

Sources:

- https://keenerfinancial.com/why-corrections-are-a-good-thing/

- https://www.smartmoneyadvice.co.nz/2015/09/06/why-market-corrections-can-be-a-good-thing/

- https://www.fool.com/investing/2021/03/23/3-reasons-stock-market-correction-very-likely-2021/

- https://www.fool.com/investing/2018/04/11/how-long-do-stock-market-corrections-last.aspx

- https://www.yardeni.com/pub/sp500corrbear.pdf

- https://www.yardeni.com/pub/sp500corrbeartables.pdf

- https://weaverwealthnc.com/wp-content/uploads/2020/05/JPM-GTM-1Q21.pdf

- https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

Please note – investing involves risk, and past performance is no guarantee of future results. Asset allocation does not ensure a profit or protect against a loss. This material is intended for illustrative purposes only and should not be construed as specific investment or tax advice.

Investment advisory services offered through MBM Wealth Consultants, LLC, a registered investment adviser. Registration does not imply a certain level of skill or training.