“The good thing is, we have household formation in this country”

Warren Buffet

As 2021 comes to a close, data suggests that a new phase of economic expansion has been underway for a full calendar year. Although headlines of historic inflation and the Federal Reserve reducing monetary policy stimulus are a cause for concern, we believe there are other key themes that will help pave the way for a multi-year economic expansion.

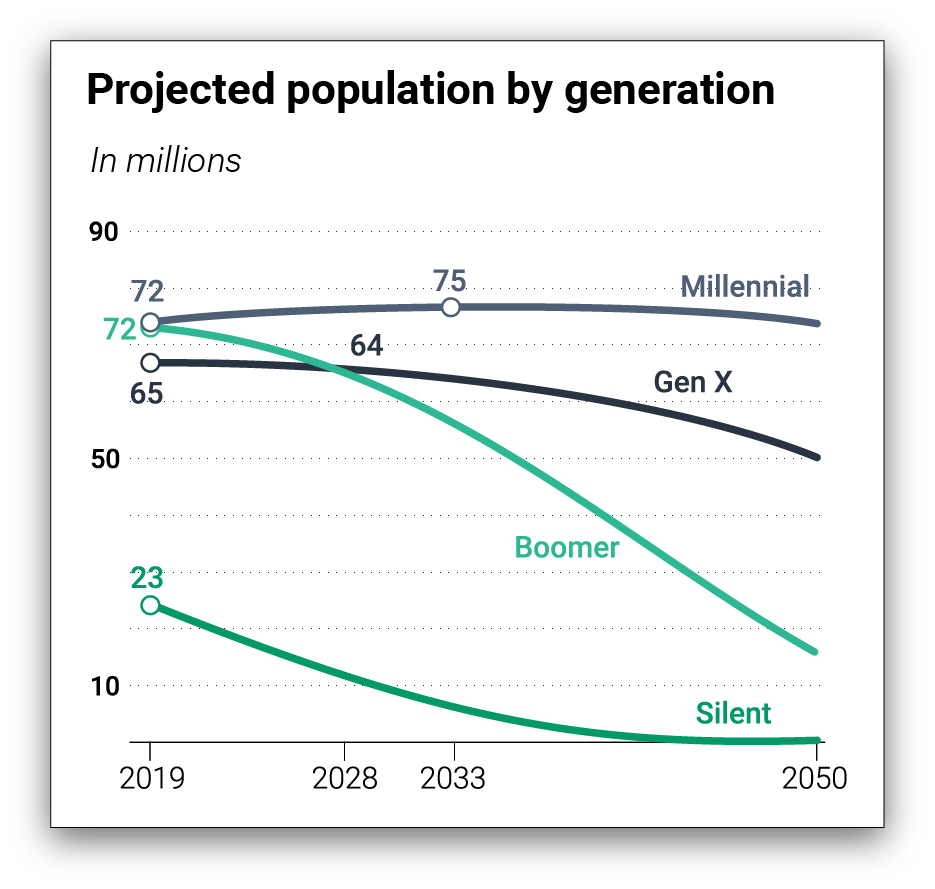

Demographic Shift

The baby boomer generation has represented the largest portion of our population over the last two decades, and as a result have had the largest economic impact on the economy. However, the millennials overtook the boomers in size in 2020 and now represent the largest portion of our population. There are several reasons why this occurrence has positive implications for our overall economy.

Prime Earning Years

According to the Bureau of Labor Statistics, workers earn the most between the ages of 35-54. Therefore, the oldest millennials are just now starting to realize their full potential in terms of earnings power, with the majority of the millennial generation still expecting to hit peak career earnings power over the next decade. As the shift in demographics continues to accelerate, the increased earning power of the millennial generation should drive economic expansion through spending. A large part of this spending will be related to household formation.

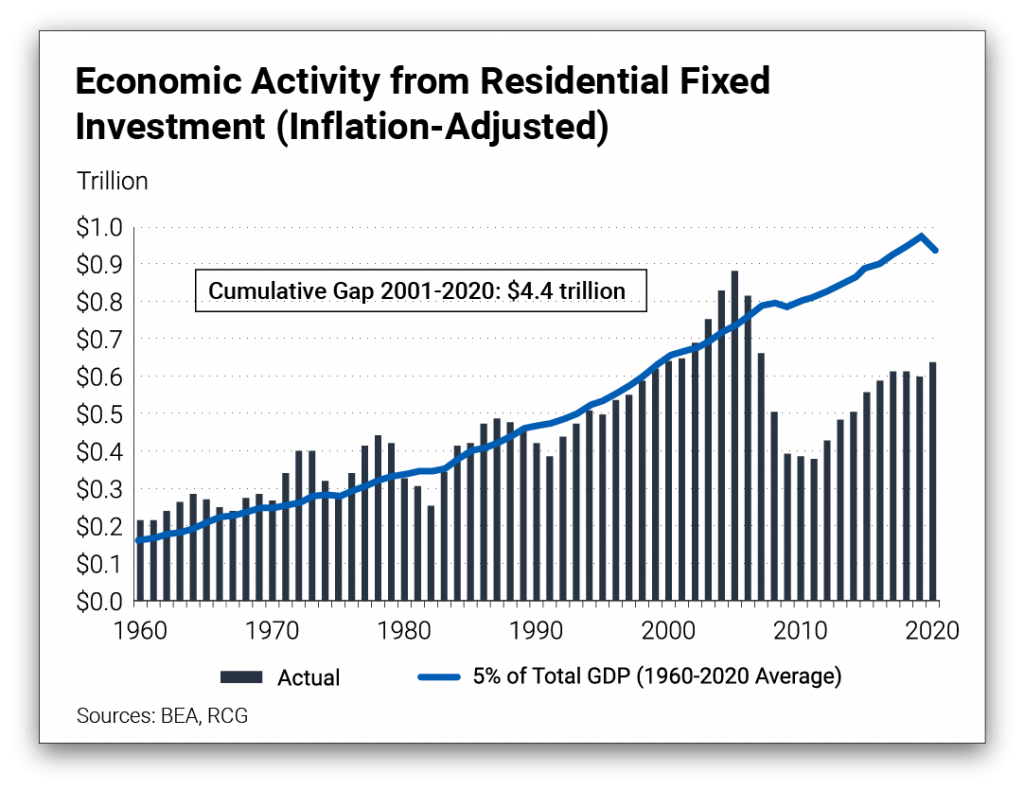

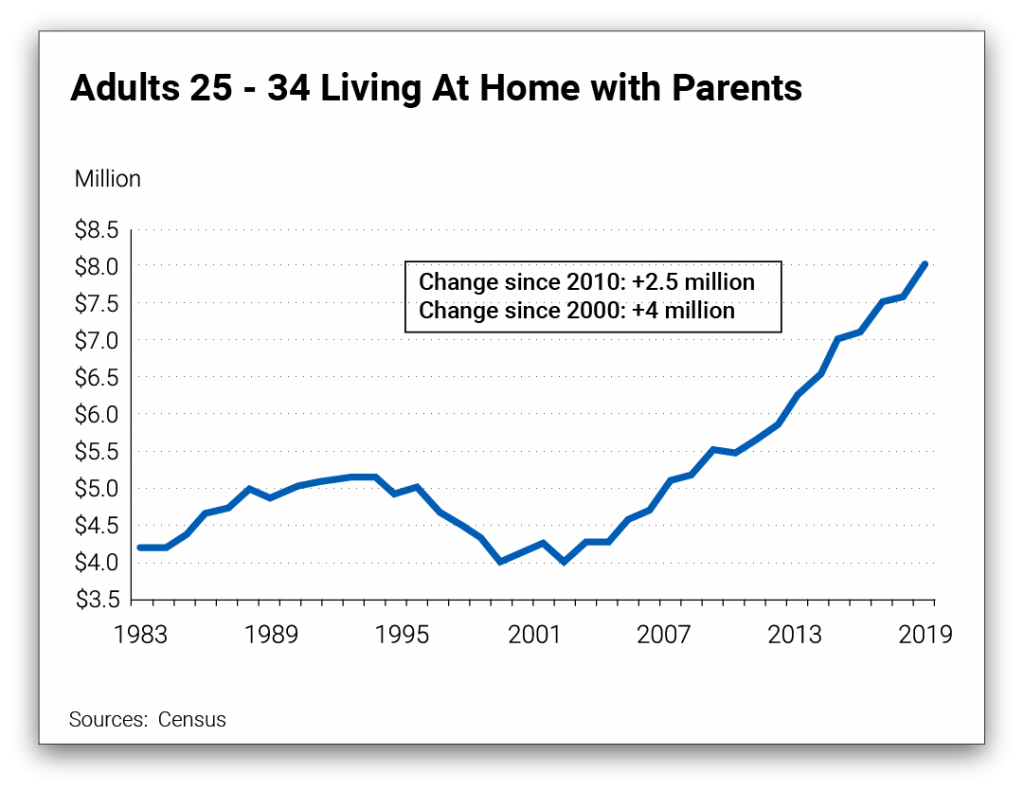

Household Formation

Traditionally, household formation and home construction (similar to infrastructure spending) lead to the highest economic multipliers. From 2010-2020, the US saw the lowest level of household formation ever recorded, as millennials delayed the process of starting families and buying homes due to the hangover of the 2008 real estate led recession1. Housing activity and demographic data suggest there is pent-up demand that is now starting to be realized as evidenced by the recent increase in house prices2. The increase in household formation is expected to be a tailwind to economic growth for the foreseeable future.

Labor Productivity

The COVID-19 pandemic accelerated the digital age. Businesses have been forced to adapt their infrastructure to a new digitally-based ecosystem. This technological advancement is a positive catalyst for labor productivity, enabling the US workforce to produce more with the same number of hours worked. From 2010-2019 labor productivity growth was 1.2%. Economists estimate labor productivity growth from 2021-2031 to be 1.7% which will be an economic tailwind. Early numbers support this thesis as labor productivity has averaged 2.15% from Q1 2020 – Q3 20213, a measure taken during a historically deep recession. Going forward, we believe that labor productivity should rise even higher than 1.7%.

It is important to note that the stock market and economy generally move in lockstep. However, market corrections do happen in an expansionary economy. Although a correction can be severe, it is generally short lived due to the strength of the underlying fundamentals. Although we are bullish on the overall direction of the economy, we remain cautious of the market over the short to intermediate term. Based on current market valuations, we expect below average returns and above average volatility until earnings grow into current valuations.

Finally, we want to acknowledge the amazing loyalty and trust of our clients over the last 18 months. We are grateful for your confidence and hope that everyone takes a moment over the upcoming holiday season to enjoy all that is good in the world.

Sources:

- https://www.pewresearch.org/fact-tank/2021/10/12/u-s-household-growth-over-last-decade-was-the-lowest-ever-recorded/

- https://fred.stlouisfed.org/series/MSPUS

- https://fred.stlouisfed.org/series/OPHNFB

- https://www.nar.realtor/sites/default/files/documents/Housing-is-Critical-Infrastructure-Social-and-Economic-Benefits-of-Building-More-Housing-6-15-2021.pdf

- https://www.forbes.com/sites/ashleystahl/2021/09/10/millennials-high-earning-years-have-arrived-heres-how-to-prepare/?sh=5e60f86a4936

- https://www.pewresearch.org/fact-tank/2020/04/28/millennials-overtake-baby-boomers-as-americas-largest-generation/

- https://www.washingtonpost.com/business/2021/08/18/us-productivity-boom/

- https://www.uschamberfoundation.org/blog/post/3-reasons-why-household-creation-key-indicator-economic-growth/33857

- https://www.economicstrategygroup.org/publication/barrero-bloom-davis-2021/

- https://www.jchs.harvard.edu/sites/default/files/Harvard_JCHS_McCue_Household_Projections_Rev010319.pdf

- https://www.forbes.com/sites/bradhunter/2019/07/08/millennials-will-re-shape-the-new-home-market/?sh=5770553f51f6

- https://blog.firstam.com/economics/will-household-formation-continue-to-boost-housing-market-potential-amid-the-pandemic

- https://www.pewresearch.org/fact-tank/2021/10/12/u-s-household-growth-over-last-decade-was-the-lowest-ever-recorded/

- https://www2.deloitte.com/content/dam/Deloitte/global/Documents/Public-Sector/gx-gps-infrastructure-economic-stimulus.pdf

- https://www.gradingstates.org/the-real-path-to-state-prosperity/investments-in-infrastructure-bring-high-returns/

Please note – investing involves risk, and past performance is no guarantee of future results. Asset allocation does not ensure a profit or protect against a loss. This material is intended for illustrative purposes only and should not be construed as specific investment or tax advice.

Investment advisory services offered through MBM Wealth Consultants, LLC, a registered investment adviser. Registration does not imply a certain level of skill or training.