“A correction is a wonderful opportunity to buy your favorite companies at a bargain price. People who exit the stock market to avoid a decline are odds-on favorites to miss the next rally”

Peter Lynch

Stock investors enjoyed substantial returns in 2020 and 2021 with the S&P 500 returning 17.88% and 28.41% respectively 1. These returns dwarfed the average return of around 10% 2. Much like 2001 and 2008, the market started to exhibit irrational exuberance as investors blindly put money into the market without a thought to what they were buying, why they were buying it, and what was it really worth. If uncorrected, this behavior creates asset bubbles. When the bubbles burst, a normal 20% correction becomes a 40+% correction. During our January investment committee meeting, we believed the best thing for the long-term health of the market was 15-20% correction with solid corporate earnings growth. This would realign the market into normal valuations and average return expectations going forward. It was our belief that another year of big returns would create an asset bubble that could have caused substantial damage in 2023 or 2024.

As of May 6th, the S&P 500 has dropped 13.07% and the Nasdaq is down 22.22%. Most of this drop is based on the fear of what could happen, not what is happening. The first fear-driven event was the Russian invasion of Ukraine. As the fear of World War 3 subsided, investors focused their fear on the Federal Reserve. As it became clear that inflation was not transitory as hoped, the Federal Reserve broadcasted an aggressive interest rate tightening cycle and investors responded with panic selling. Calls for a recession are common right now. We suspect this is more headline selling that reality. Unemployment is near an all-time low, bank assets are near an all-time high3, and consumer debt-to-income remains well below the average for the last few decades4. All of this indicates that consumers have the ability to continue spending which will keep corporate earnings strong.

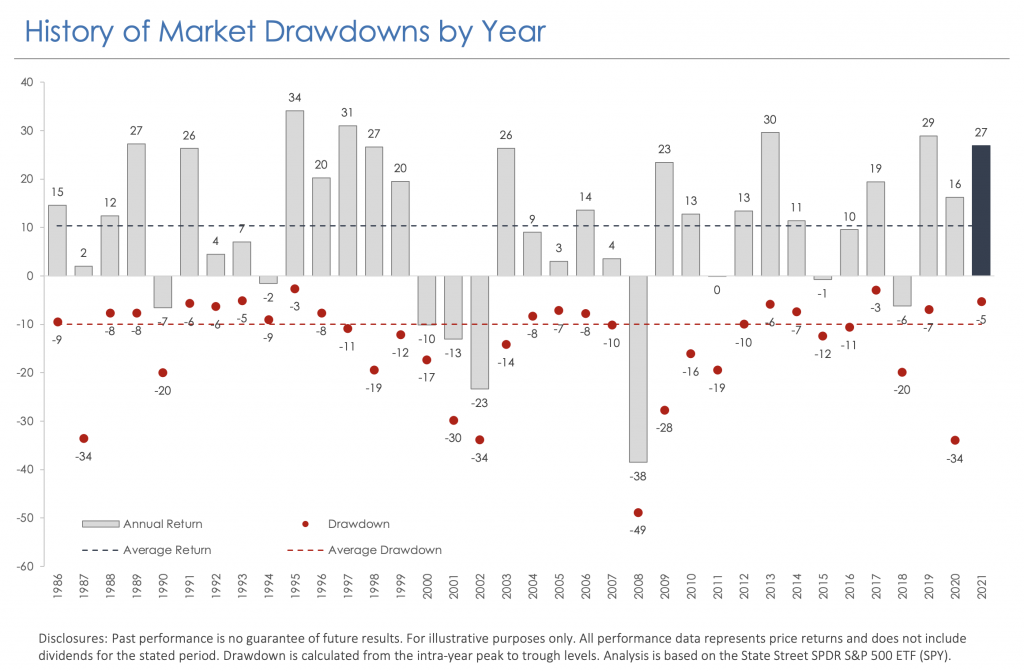

As the chart illustrates, intra-year declines are not a reliable predictor of how the market finishes the year.

The unpleasant truth is stock market corrections are a lot like salads. They don’t feel and taste all that great but they play an important role in your long-term health and the market is going through a healthy reset. Although we do not expect robust returns in 2022, the level of volatility is normal and should set us up for a healthy market cycle as corporate earnings continue to grow into the adjusted valuations. It should be noted that there are economic and market risks that were not present six months ago, but a major market correction does not appear likely. Leading indicators suggest that inflation has peaked which will allow the Federal Reserve to be more calculated in their interest rate strategy. Once this fear is alleviated, the underlying strength of the US economy should propel the market forward.

The fear of what could be does not make a good or long-term investment strategy. During bouts of market volatility, buying companies with a solid growth strategy and a management team capable of executing it will yield good future returns. Forward thinking and patience will be rewarded.

Sources:

1– These figures are the total return for the given year, which includes dividend reinvestment.

2 – What Is The Average Return Of The Stock Market? https://seekingalpha.com/article/4502739-average-stock-market-return

3 – On Point: Economic And Policy Insight from the OCC; January 2022. Banking System is Carrying “Excess” Deposits https://www.occ.treas.gov/publications-and-resources/publications/economics/on-point/pub-on-point-deposit-growth-slowing-low-cost-funding-endure.pdf

4 – Household Debt Service Payments as a Percent of Disposable Personal Income. Jan 1, 1980 to Oct 1, 2021. https://fred.stlouisfed.org/series/TDSP

Please note – investing involves risk, and past performance is no guarantee of future results. Asset allocation does not ensure a profit or protect against a loss. This material is intended for illustrative purposes only and should not be construed as specific investment or tax advice. Investment advisory services offered through MBM Wealth Consultants, LLC, a registered investment adviser. Registration does not imply a certain level of skill or training.