“Be fearful when others are greedy, and greedy only when others are fearful.”

Warren Buffet

The S&P 500 index officially entered bear territory on June 13th, 2022, when it closed down 21.8% from its high reached on January 3rd, 2022. A bear market is defined as a 20% or more drop from recent highs. For many investors, it is a symbolic number that signals a recession. In 2022, Wall Street continues to focus on what could happen as opposed to what is happening. It is uncertain to even the best analysts if these fears will come true as half say the market will rebound by the end of year and the other half see more downside. It is a guessing game that most investors should completely ignore! As with most things in life, fundamentals are increasingly important in the light of uncertainty.

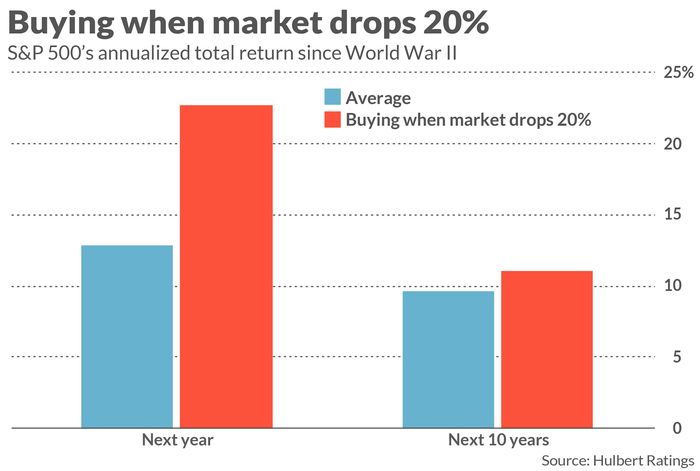

The stock market is one of the few things that people do not want to buy when it goes on sale. If one thought that investing money was good at the beginning of the year, one should believe it is even better now 1. That is easier said than done (emotionally) but history proves that buying during a bear market yields good success. If one purchased the S&P 500 index the day it entered a bear territory, that investor would have been positive 83% of the time within 12 months with an average gain of 22.7%.

The market climbs a wall of worry and it is tempting to say that it is different this time; however, that is at least partially emotions talking and not the facts of history. Inflation, war, rising interest rates, recessions, and market drops have all happened before. ‘It’s different this time’ may be the most dangerous, expensive phase when it comes to investing. Very few good things in life are easy and getting over the emotional barrier of investing during market volatility is near the top of the difficulty list. During periods such as this, one can capitalize by:

- On a worst-case scenario, investors should maintain their current equity positions. Although it is tempting to try and avoid losses, this is a sure-fire way to miss out on market upside. Those that do try to time the market end up with two tough decisions, when to get out and when to get back in. Generally, investors believe the market will continue to have more downside. When the market does rebound, investors tend to discount the reality of the rally. Once a market rally is confirmed, there is additional fear that getting in now will result in catching a falling knife. This results in paralysis and lost market returns.

- Everyone needs an emergency fund, but too much of a good thing can cause harm, especially in a low interest high inflation environment. Bank assets lure investors into a false sense of security because market loss does not show up on a statement. The loss of purchasing power to inflation is more gradual and less visible, but just as much of a risk as market loss. Everyone’s emergency fund needs are different, but now is the time to move money into the market if your financial plan dictates a reduction in emergency reserves.

- If your emergency fund is adequately but not overfunded, consider adjusting the allocation of your portfolio. In a rising interest rate environment, bond principal decreases. In addition, assuming a 3% interest rate on bonds, the real return (inflation – interest rate) is negative so what are you really getting? Smart investors would consider moving a portion of their portfolio from bonds to stock; however, it is important that the portfolio maintains enough safety to satisfy at least 4-6 years of potential capital needs to prevent a stock from being sold at a bad time. A well-built financial plan should provide the peace of mind of knowing what that number is for each investor’s unique circumstance.

MBM does not know if we are at an exact market bottom, but we do know that good stocks can be purchased at 25%–40% less than what they were 6 months ago. This lends itself to attractive risk-versus-return ratios. When considering a portfolio reallocation, make sure it still fits within the directives of your overall financial plan. If you do not have a financial plan, now is the time to develop one so the tail does not end up wagging the dog.

These are challenging times in all areas of life. MBM thanks you for your continued support and loyalty!

Sources:

1– MarketWatch – Opinion: Those who buy stocks the day the S&P 500 enters a bear market have made an average of 22.7% in 12 months. June 14, 2022. https://www.marketwatch.com/story/those-who-buy-stocks-the- day-after-the-s-p-500-enters-a-bear-market-have-made-an-average-of-22-7-in-12-months-11655224023

Please note – investing involves risk, and past performance is no guarantee of future results. Asset allocation does not ensure a profit or protect against a loss. This material is intended for illustrative purposes only and should not be construed as specific investment or tax advice.

Investment advisory services offered through MBM Wealth Consultants, LLC, a registered investment adviser. Registration does not imply a certain level of skill or training.