“Are we there yet?”

– A family member of yours during a past road trip (probably)

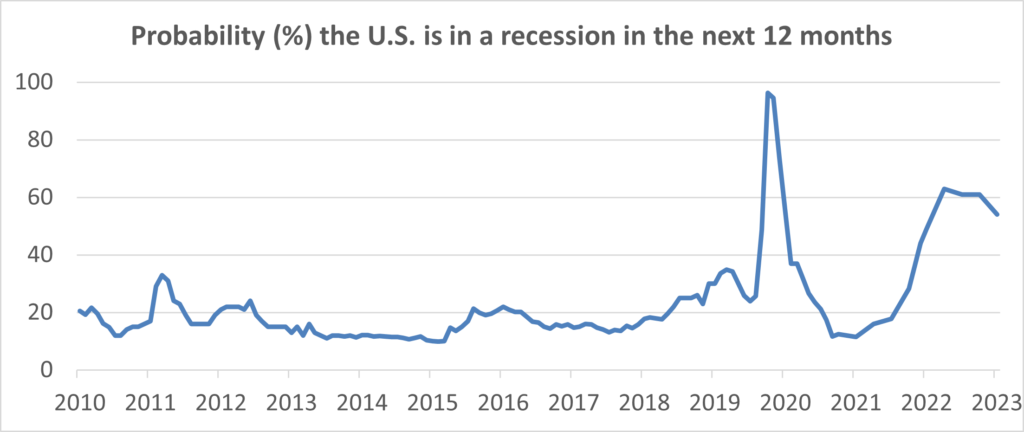

In late 2022, professional economists gazed into their crystal balls and made near-term forecasts for the U.S. economy & markets. Many of these predictions focused not on if but when the U.S. would stumble into a recession in short order, due to concerns that the Federal Reserve’s rate hike battle with inflation would lead to lower growth and job losses. In October 2022, 63% of economists surveyed by the Wall Street Journal predicted a recession within the next 12 months, and the average prediction for GDP growth rates in both the first and second quarters of 2023 were negative.

As 2023 has progressed, forecasters have been forced to modify their estimates (GDP growth was positive in the first two quarters this year) and push back their recession timelines as elements of the U.S. economy have demonstrated resilience. Meanwhile, investors wait for the consensus recession headline predictions to match reality and are left to wonder: “Are we there yet?”

As we mentioned in our previous article “Recessionary Woes”, we have observed three things that usually exist during recessions: 1) There are no jobs, 2) Consumers & businesses aren’t spending money, and 3) Businesses aren’t making money. Let’s look at the current state of those three areas:

Jobs & Employment:

- Job openings remain elevated relative to history.

- The unemployment rate hit a 53-year low in early 2023 and has remained at 4% or below since the end of 2021.

- Initial unemployment claims have remained steady for the past 18 months.

- Labor force participation among prime age workers is currently at its highest level since 2008.

Consumer & Business Spending:

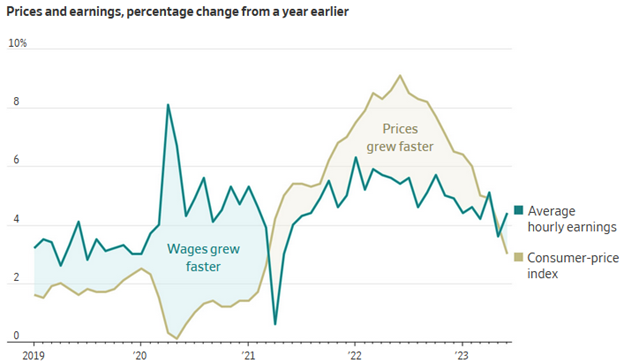

- Wages have continued to grow and the rate of growth has recently begun to outpace inflation, as headline inflation has shown signs of deceleration in recent months (pictured below).

- Consumer spending remains a positive contributor to GDP growth. U.S. households still maintain a notable savings reserve, which is expected to help buoy consumer spending into year-end.

- Businesses continue to spend on hiring and payrolls, with signs of companies ‘hoarding’ employees due to the difficulty of finding workers during the pandemic.

- Overall business investment declined slightly in Q1 2023 but grew in Q2, with notable growth in manufacturing and power & communication infrastructure.

Revenues & Profits:

- In Q1 2023, the S&P 500 index recorded positive year-over-year growth in earnings (3%) and revenues (4%). Aggregate earnings grew during the quarter, defying negative growth predictions by analysts at the beginning of the quarter (+0.1% actual versus -5.1% estimated).

- Earnings expectations on a 12-month forward basis for the S&P 500 index have risen steadily year-to-date.

- Quarterly profit margins for the S&P 500 index remain positive, declining slightly over the course of 2022 but ticking back up in Q1 2023.

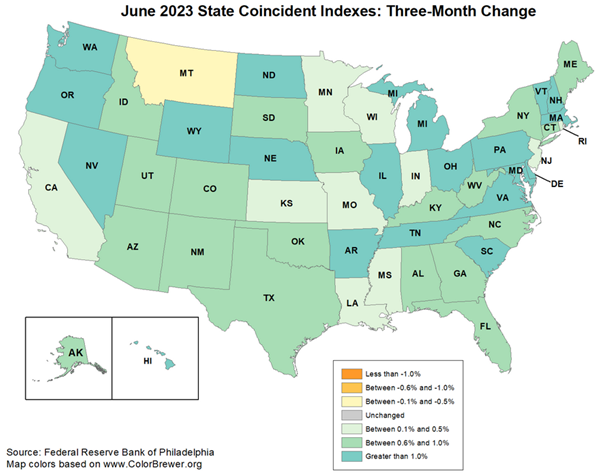

In summary, none of the three major aspects are ‘screaming’ we are currently in an economic downturn. A recession is often defined as two consecutive quarters of negative economic growth. Since GDP data is reported with a lag, it is backward-looking – a recession using this definition is identified only with the benefit of hindsight. Attempting to detect a recession in real-time is more challenging, however there are data sources that help provide clues. The Federal Reserve Bank of Philadelphia computes coincident indices to help provide a real-time view of economic conditions on a state-by-state level. The most recent map (pictured below as of June 2023) indicates 49 of 50 states were continuing to show signs of economic growth:

The U.S. economy does face potential headwinds, including the possibility of a Fed policy error, decelerating trends in leading economic indicators, and tightening financial conditions. The exact path of any business cycle and the type of economic “landing” scenario that may unfold is impossible to predict. Forecasting the path of our current cycle is perhaps made even more complicated given the unwinding of the interest rate regime and fiscal policy responses over the previous decade. Even the Federal Reserve has sent mixed signals, forecasting a 2023 recession in March but changing their tune just 4 months later in July. Given the recent forecasts that permeated the headlines, to date the fears of an imminent recession have been overblown.

Since trying to exactly time the next recession is futile, what can an investor do? First, stick with your financial plan – it was designed to help guide you and your portfolio through short-term and long-term cycles, not just certain phases of the cycle, to reach your goals. Second, play the hand the markets have dealt to your advantage. This year, short-term interest rates have drifted higher and growth stocks have rallied significantly. At MBM, we have capitalized on higher rates by allocating to high credit quality bonds that offer yield levels rarely seen over the past decade, and we regularly rebalance portfolios to align with established risk targets with a focus on tax-efficiency.

All of us at MBM appreciate your continued trust and support, and we hope you had an enjoyable summer!

Please note – investing involves risk, and past performance is no guarantee of future results. Asset allocation does not ensure a profit or protect against a loss. This material is intended for illustrative purposes only and should not be construed as specific investment or tax advice.

Investment advisory services offered through MBM Wealth Consultants, LLC, a registered investment adviser. Registration does not imply a certain level of skill or training.

Sources:

- St. Louis Fed data:

- https://www.wsj.com/articles/january-jobs-report-unemployment-rate-economy-growth-2023-11675374490?mod=article_inline

- https://www.wsj.com/articles/pay-raises-are-finally-beating-inflation-after-two-years-of-falling-behind-3e89bc2d?mod=series_inflation

- https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/employers-hoard-labor-as-economy-weakens-boosting-odds-of-a-job-loss-wave-75601612

- https://www.bea.gov/news/2023/gross-domestic-product-third-estimate-corporate-profits-revised-estimate-and-gdp-industry

- https://www.frbsf.org/economic-research/publications/economic-letter/2023/may/rise-and-fall-of-pandemic-excess-savings/

- https://www.spglobal.com/marketintelligence/en/news-insights/blog/sp-500-q1-2023-sector-earnings-revenue-data

- https://www.carsongroup.com/wp-content/uploads/2023/07/CP_MYO_2023_071123_Final-1.pdf

- https://www.lpl.com/newsroom/read/weekly-market-commentary-earnings-update-better-than-feared-undersells-results.html

- https://www.philadelphiafed.org/surveys-and-data/regional-economic-analysis/state-coincident-indexes

- https://www.reuters.com/markets/us/fed-staff-no-longer-forecasting-us-recession-powell-says-2023-07-26/