“Emphasize the reflective over the reactive”

~ James Aitken

The holiday season allows a chance to step back, spend time with loved ones, and reflect on events over the past year. Within the financial realm, some of the major themes of the year included the Federal Reserve & interest rates, the resilient performance of the stock market amidst headline recession predictions, and the effect of inflation on consumers. Here are some of the considerations for each of these areas as we approach year-end:

Federal Reserve

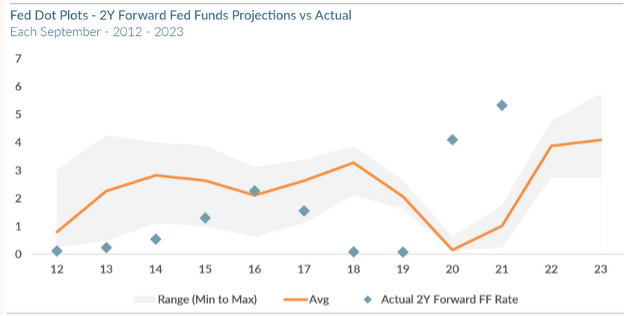

The Fed chose to pause rate hikes at their previous three meetings in September, November, and December. While previously stating future increases have not been ruled out, Fed chairman Jerome Powell’s most recent comments suggest the Fed’s primary focus of late on slaying the inflation dragon will be more balanced with the health of employment going forward. The Fed cannot claim victory in their fight against elevated inflation yet, but concerns at the beginning of the rate hike cycle over combating high inflation are now balanced with concerns that rate hikes may be contributing to an overtightening in financial conditions. Thus far, the Fed has not crashed the economy in their quest to cool inflation. However, the last mile in the inflation journey may indeed prove to be the hardest, as inflation has remained “sticky” in areas such as shelter and core services. The most recent Fed projections in December indicate the committee is forecasting 3 interest rate cuts next year. However, interest rate predictions from the Fed should be taken with a grain of salt, as history has shown their prediction accuracy track record is poor. The below chart shows the Fed’s 2-year forward predictions (orange line) versus the actual rate 2 years later (blue diamonds):

Markets

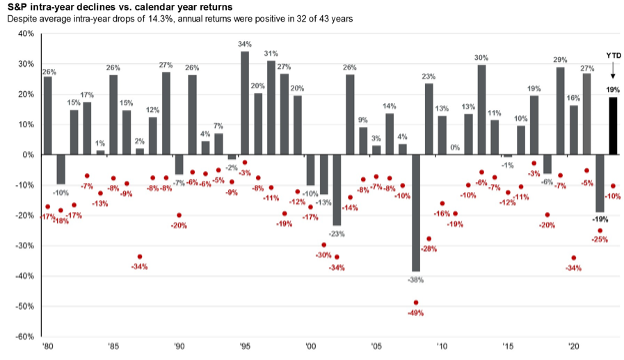

U.S. equity markets have defied recession predictions from experts over the course of the year, with gains in the first half of the year largely powered by large cap tech companies. However, markets did experience some turbulence during the 3rd quarter. From its high in late July, the S&P 500 index experienced a 10%+ drawdown through the end of October on worries related to higher interest rates sticking around for longer than initially anticipated and a renewed war in the Middle East. However, sentiment quickly pivoted in November and markets rallied, sparked in part by news that inflation continued its cooling trend. The broad-based November rally featured strong market breadth, as a higher number of stocks beyond big tech participated in the market’s upward move. On the fundamentals side, GDP growth estimates for Q4 remain positive albeit at a lower level than Q3, and analyst estimates for Q4 S&P 500 earnings are currently in positive territory but are showing a trend of downward revision. We have argued previously that corrections can offer benefits for the long-term health of the market (“Market Corrections and Salad”). The volatile market environment over the past three months serves as a reminder of a few important investing concepts: trying to perfectly time the market is a largely futile endeavor, market corrections occur with some regularity, and notable drawdowns can occur during years of strong returns, illustrated by the below chart with YTD 2023 depicted in the rightmost column:

Consumers

Headline predictions of an imminent recession weighed on investor sentiment over the past year. On the bright side, a recession failed to materialize during 2023 as the U.S. economy and consumers demonstrated resiliency. U.S. GDP grew strongly in the 3rd quarter powered largely by consumer spending.

Although the rate of change of inflation has slowed, inflation is still positive – aggregate prices have slowed their dramatic pace of increase but are still drifting higher, nonetheless. Additionally, higher interest rates have translated to higher debt costs across new mortgages, loans, and credit, and delinquencies and downgrades/defaults have ticked higher from their previously low levels. Households in general came into 2023 on solid financial footing but have all felt the “sting” of higher costs.

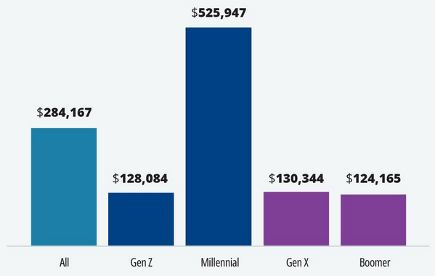

A recent survey offers a glimpse into the effects of higher costs on consumer psyches. Millennials – a group that has only known low interest rates and mild inflation over their adult lives – currently believe they need a much higher income than other age groups to feel happy or less stressed. This cohort which is in its household formation years has seen sticker shock from multiple angles, including home prices & rents, childcare, education, and healthcare.

How much does your annual salary need to be for you to feel happy/less stressed?

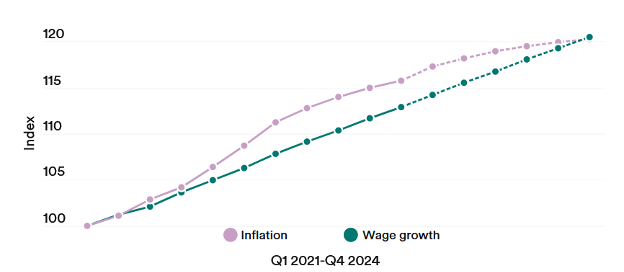

To be sure, all age groups are feeling these effects to some degree. Wage growth has recently begun to outpace inflation, but overall wages are still playing catch-up to price increases since the COVID pandemic. Based on the current pace of inflation and wages, the gap between these two levels is not expected to fully close until late 2024:

Source: Bankrate, Department of Labor. Data is indexed to 100 starting in January 2021.

Closing Thoughts

Given the potential for a range of economic and inflation outcomes, what is the prudent course of action? In times of heightened uncertainty, it is normal to feel significant action is needed or warranted. However, a financial plan is built for all seasons, and the portfolios we construct & manage allow our clients to successfully navigate their long-term plan.

Equities have historically shown the ability to participate in the growth of the economy and to “outrun” inflation over the long-term and remain a core portfolio building block. Within our stock portfolios, we continue to focus on high quality companies that can succeed based on the merits of their underlying business, rather than low quality companies which may be more subject to the whims of speculation or sentiment. Within fixed income, we have capitalized on higher rates by investing in high credit quality shorter-duration bonds, which continue to offer a balance of downside protection and income generation.

From all of us at MBM, we are truly grateful for your partnership over the past year. We wish you a happy, healthy, & wonderful holiday season and a happy new year!

Sources:

- https://lplresearch.com/2023/11/02/the-fed-remains-unchanged-again/

- https://www.wsj.com/economy/central-banking/fed-holds-rates-steady-and-sees-cuts-next-year-4d554e9f

- https://www.wsj.com/economy/central-banking/the-fed-underwrites-the-recovery-0573826c

- https://www.wsj.com/economy/what-to-watch-in-cpi-report-firm-underlying-inflation-could-complicate-prospect-for-interest-rate-cuts-c6d881a9?mod=hp_lead_pos3

- https://www.glenmedeim.com/market-snapshot-when-forecasting-interest-rates-gets-cloudy/

- https://www.barrons.com/articles/stock-market-rally-interest-rates-yields-cfe4ee97

- https://insight.factset.com/analysts-making-larger-cuts-than-average-to-eps-estimates-for-sp-500-companies-for-q4

- https://am.jpmorgan.com/us/en/asset-management/protected/adv/insights/market-insights/guide-to-the-markets/

- https://www.wsj.com/articles/third-quarter-growth-gdp-consumer-spending-business-investment-economy-fb6b0e26

- https://www.empower.com/the-currency/money/research-financial-happiness

- https://www.carsongroup.com/insights/blog/10-charts-showing-why-were-not-yet-worried-about-the-consumer/

- https://www.bankrate.com/banking/federal-reserve/wage-to-inflation-index/