“If voting made any difference they wouldn’t let us do it.”

~ Mark Twain

Although 2024 may be the Year of the Dragon according to the lunar calendar in Asia, perhaps it is more appropriate to call 2024 the Year of the Election. This year people across the world in more than 60 countries including Taiwan, the European Union, United Kingdom, India, South Korea, Mexico, South Africa, and of course, the United States will travel to their respective polling places to cast their vote.

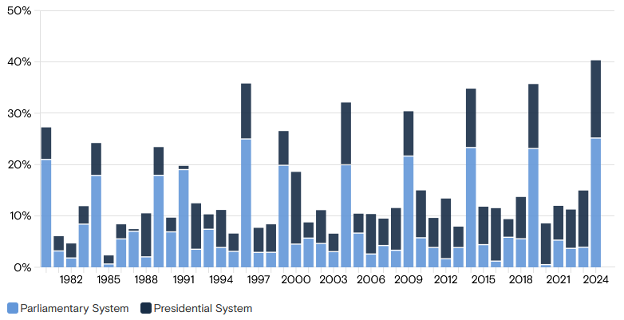

Elections by World Population Weight

Much of the world’s spotlight will be on the November elections in the United States, which will decide control of both the White House and Congress. The two leading presidential candidates from the Republican (Trump) and Democratic (Biden) parties are scheduled for a rematch of 2020, generating a mix of both anxiety and enthusiasm across the electorate and even within their respective parties. Thus far, equity markets have shrugged off potential concerns about the upcoming election cycle, as the S&P 500 index posted its best first quarter performance since 2019.

Although elections may spark a range of emotions for investors, they tend to dominate news headlines and attention spans more than they affect the long-term success of the markets. Using history as a guide, here are some points to consider:

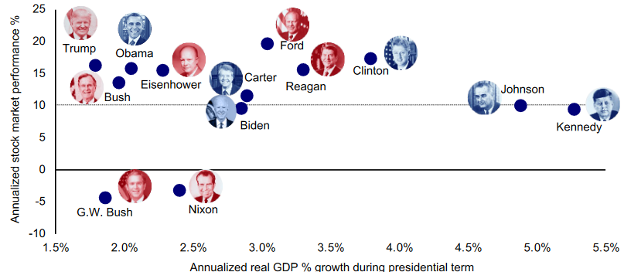

- The U.S. stock market has historically performed well under both political parties

- The S&P 500 index has recorded positive returns across most Presidential terms in modern times.

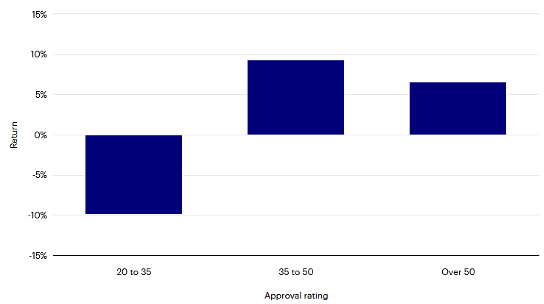

- The U.S. stock market can perform well even if the president is unpopular

- Since the 1960’s the S&P 500 index return has been highest when the president’s approval rating is between 35% and 50%. Stock markets can do well even if over half of the country doesn’t like the President.

- Monetary policy conditions during an administration have a significant impact on market performance

- Historically, equity market returns during a President’s tenure have been helped or hurt by monetary policy decisions from the Federal Reserve. Periods of easing conditions during an administration have helped equity returns (Reagan, Clinton, Obama), while periods of tightening have hurt (Bush, Trump).

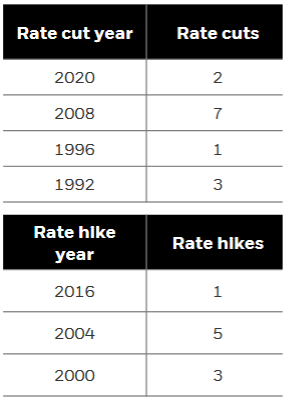

- The market is currently expecting the Federal Reserve to cut rates at some point this year, which may be a tailwind to returns during the beginning of the next administration’s term, barring a recession. An election year has not prevented the Fed from adjusting interest rates in the past.

Though the level of political polarization and concerns about government dysfunction are currently high, perhaps a silver lining is the fact that these concerns are not new. The United States has persevered despite fiery rhetoric from our political leaders throughout our history. For example, try and guess the sources of the following quotes:

“The distemper in our nation is…certainly incurable.”

“The (US central bank) is one of the most deadly hostilities existing…”

“Public debt is a public curse.”

If you guessed anyone who was alive after the 19th century, you are incorrect. In fact, these strongly-worded concerns were expressed by our nation’s founding fathers – George Washington, Thomas Jefferson, and James Madison, respectively. You may remember from history class (or the musical/movie Hamilton) that our country once witnessed a duel between the Vice President and a former Secretary of the Treasury. Until Kamala Harris and Stephen Mnuchin duel each other with pistols, perhaps thankfully our political polarization has not reached the point of no return.

Humans are wired to prefer action over inaction because uncertainty about the future causes a feeling of a lack of control. One reason why successful investing is difficult is because taking action doesn’t automatically translate to a better outcome and can be at odds with successfully achieving financial goals. The outcome of the upcoming elections is uncertain, but making drastic changes to your investments is likely not the best course of action. For the upcoming election season, know that the news outlets will be vying for your attention with dramatic predictions and prognostications, but avoid letting it translate to worrying about the long-term health of your portfolio. Have peace of mind that your financial plan was built to guide you to success throughout the years, not just in election years.

From all of us at MBM, we value your continued trust & support and hope your year is off to a good start!

Sources:

- https://www.goldmansachs.com/intelligence/pages/how-the-worlds-record-share-of-elections-ripple.html

- https://www.wsj.com/articles/presidential-election-2024-biden-trump-2c1e9bcc

- https://www.invesco.com/us/en/insights/market-performance-2024-presidential-election.html

- https://www.invesco.com/us-rest/contentdetail?contentId=60c1690e-4d5d-45a5-a08d-6745bbe71039

- https://thedecisionlab.com/biases/action-bias