“The investor’s chief problem, and even his worst enemy, is likely to be himself”

– Benjamin Graham

Cryptocurrencies (or ‘crypto’ for short) have made a dramatic rise to prominence in today’s media cycle. This relatively new type of asset tends to fluctuate in value rapidly, giving it the eye-catching shock value that captures human attention. The news is full of stories about crypto traders that have made large returns in a short amount of time. Although emotional bias can affect all investment decisions, it tends to increase with highly volatile assets like cryptocurrencies.

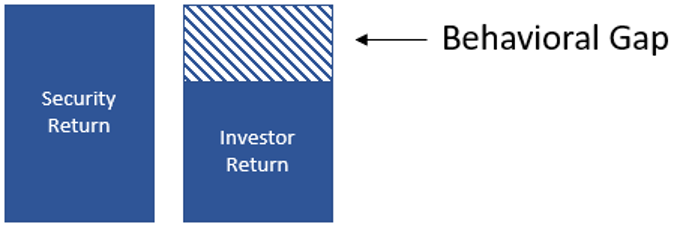

The price of Bitcoin has been extremely volatile since its inception. Whether on the right or wrong side of a trade, emotions tend to swing in lockstep with the fluctuations in price. These emotions lend themselves poorly to investment execution regardless of being positive or negative. The emotional bias that inherently comes with a gain or loss is harmful if not recognized. In fact, research suggests that emotions cause humans to lose out on investment returns by trading in-and-out of securities, resulting in what is called the “behavioral gap.”

Appreciation After Purchase

Due to the wild swings in the price of Bitcoin, the potential for large emotional error increases. If it appreciates shortly after the investor purchases it, the investor will most likely be greeted by overconfidence and availability bias. Both biases tend to increase as the return increases. Overconfidence is a bias in which people attribute unwarranted faith in their own abilities. It becomes intensified when combined with self-attribution bias. Self-attribution bias is when people take responsibility for success and assign blame to others for failures. Overconfidence can also lead to self-control bias. This is when people fail to act in pursuit of their long-term goals in favor of short-term satisfaction.

When an investor buys an asset and it immediately appreciates, they can also fall victim to representativeness bias. Representativeness refers to the tendency to classify new information based on past experiences. In the event an investor buys Bitcoin and sees immediate price appreciation, they tend to extrapolate the success in their head going forward instead of fully considering the potential downside risks that arise as new information comes out.

Depreciation After Purchase

When an investor buys a security and it immediately declines in value, they can fall victim to anchoring, endowment, and loss aversion biases.

Anchoring bias refers to relying on an initial piece of information to make subsequent estimates and decisions. People tend to estimate value with an initial default number or “anchor.” If an investor buys Bitcoin at $40,000 and it goes down to $20,000, they typically will tend to think of that initial $40,000 number as the place to begin estimations for the future. Regardless of how the initial anchor was chosen, people tend to adjust their anchors insufficiently and produce end approximations that are, consequently, biased.

Endowment is an emotional bias in which people value an asset more when they own it than when they do not. Standard economic theory suggests that market value is the price at which one person is willing to pay for an asset and another person is willing to sell the same asset. However, psychologists found that people tend to hold their own possessions in higher value than they are actually worth. Effectively, ownership “endows” the asset with added value. In the case of Bitcoin, people could be unwilling to sell, because they do not agree with the selling price available at the time.

Loss aversion refers to the tendency to strongly prefer avoiding losses over achieving gains. The emotional pain of admitting to a poor decision can leave an investor paralyzed. Loss aversion causes investors to hold their ‘losers’ (poorly performing assets) and avoid realizing losses, which can lead to inefficient tax treatment and straying from long-term financial plans.

These biases can rear their heads even when investing in traditional asset classes. Considering the level of volatility in cryptocurrencies, emotions and biases can be an even stronger influence. It is important to keep in mind these hidden risks and understand that cryptocurrency investing should be considered a form of recreation and not a necessary part of a long-term financial plan.

Sources:

- https://awealthofcommonsense.com/2013/04/the-behavior-gap/

- https://blogs.cfainstitute.org/investor/2015/07/27/how-financial-advisers-can-help-close-the-behavior-gap/

- https://www.cfainstitute.org/-/media/documents/protected/refresher-reading/2022/pdf/behavioral-biases-individuals.pdf

Please note – investing involves risk, and past performance is no guarantee of future results. Asset allocation does not ensure a profit or protect against a loss. This material is intended for illustrative purposes only and should not be construed as specific investment or tax advice.

Investment advisory services offered through MBM Wealth Consultants, LLC, a registered investment adviser. Registration does not imply a certain level of skill or training.