“The stock market has predicted nine out of the last five recessions.”

– Paul Samuelson, Nobel Prize winning economist

2022 can best be described as a year of fear. It started with overblown fear of the Russia-Ukraine war turning into World War 3. As that fear subsided, investors turned their attention to inflation and the Federal Reserve’s monetary policy to reduce it. When you combine both fears, the predominant theory is that the US economy is heading for (or already is in) a recession and the economic data appears to back that up. According to Investopedia, a recession is a significant, widespread, and prolonged downturn in economic activity. Because recessions often last six months or more, one popular rule of thumb is that two consecutive quarters of decline in a country’s Gross Domestic Product (GDP) constitutes a recession.

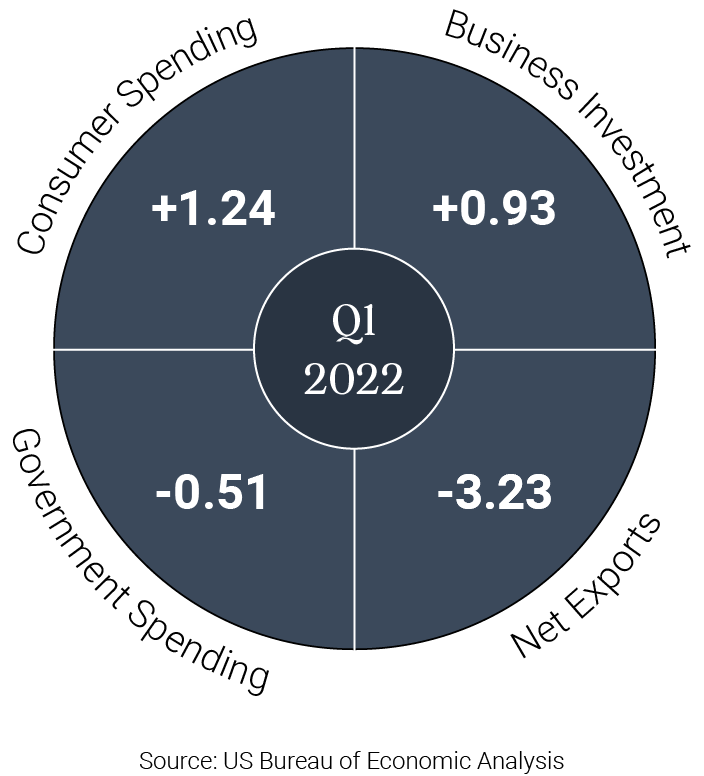

In the first quarter of 2022, GDP decreased 1.6% and in the second it decreased by 0.9%, thus hitting the technical definition of a recession. However, in this unprecedented time, a deeper dive into the data tells a different story and I do not believe the US is in a recession.

Although the second quarter GDP components have not been released, it is expected to match that of the first quarter.

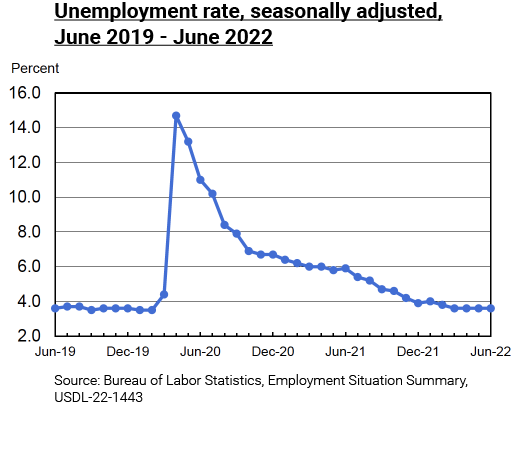

The second part of the definition of a recession is equally as important as the first. Per Investopedia, recessions typically produce declines in economic output, consumer demand, and employment.

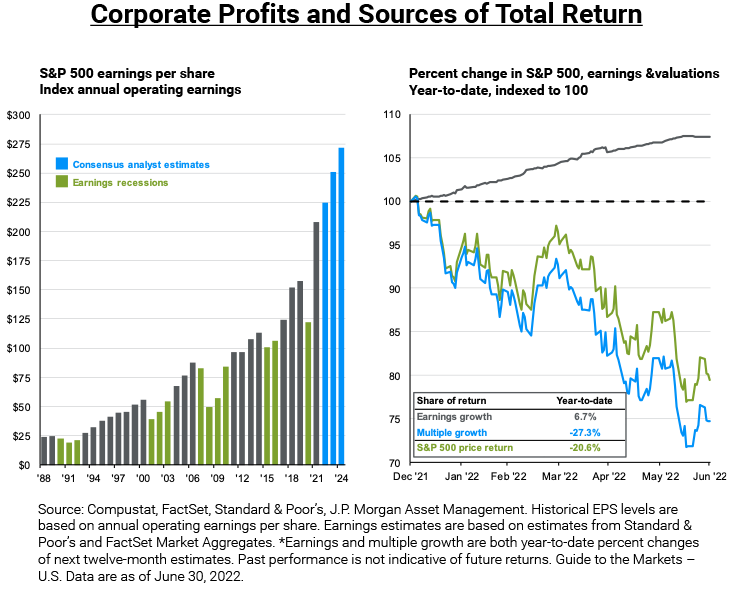

The breakdown of the GDP growth indicates that consumer and business investment spending grew at a healthy pace. I expect this to continue based on the strong labor market and high corporate profitability.

The negative net imports, which is the primary reason for the negative GDP, gives us two key takeaways. The first one is that the lockdown in China is negatively affecting their spending and need for US imports. As China eases its restrictions, we are likely to see increased spending much like when the US removed the lockdowns of 2020. This should help erase the negative net exports in the upcoming quarters. The second takeaway is that the US is importing substantially more than the rest of the world because our economy is healthy and there is high consumer demand for goods. This is also likely to continue based on the relative health of the US economy compared to the other major world economies which will dampen the reported GDP growth going forward.

Simply put, a strong jobs market and growing corporate earnings are not in the recipe for an economic recession. That being said, inflation and the actions needed from the Federal Reserve to calm it, are a risk that did not exist a year ago. However, recessionary fears are currently overblown and more a product of media fear-mongering the ‘what-ifs’ than reporting the current reality.

The consensus seems to think the economy is in a recession and the market reacted to that. When there is a consensus opinion, it is helpful to remember that the market will do what the market needs to do to prove the greatest number of people wrong. The stock market is a leading indicator. It goes down before the economic data says it should and recovers before the economic data says it should. The market does some guessing and trades on forward-based conclusions which is why it is historically a poor indicator of an economic recession. MBM believes the market is at a tipping point as it sorts out the current economic data and picks a direction. We would not be surprised if the market erased all the losses before year end or tested the lows before making the final recovery. Either way, the key to long term success is staying true to the fundamentals of investing.

Please note – investing involves risk, and past performance is no guarantee of future results. Asset allocation does not ensure a profit or protect against a loss. This material is intended for illustrative purposes only and should not be construed as specific investment or tax advice.

Investment advisory services offered through MBM Wealth Consultants, LLC, a registered investment adviser. Registration does not imply a certain level of skill or training.