“Recession is opportunity in wolf’s clothing.”

~ Robin Sharma

It is nearly impossible to turn on the news or browse on the internet without being flooded with recessionary talk. As we’ve previously dIt is nearly impossible to turn on the news or browse the internet without being flooded with recessionary talk. As we’ve previously discussed throughout the year, we don’t believe the United States is in a recession; however, the probability of a recession verses a soft landing of the economy has increased. As we get ready to turn the page into 2023, these are the key factors that we are watching.

Federal Reserve

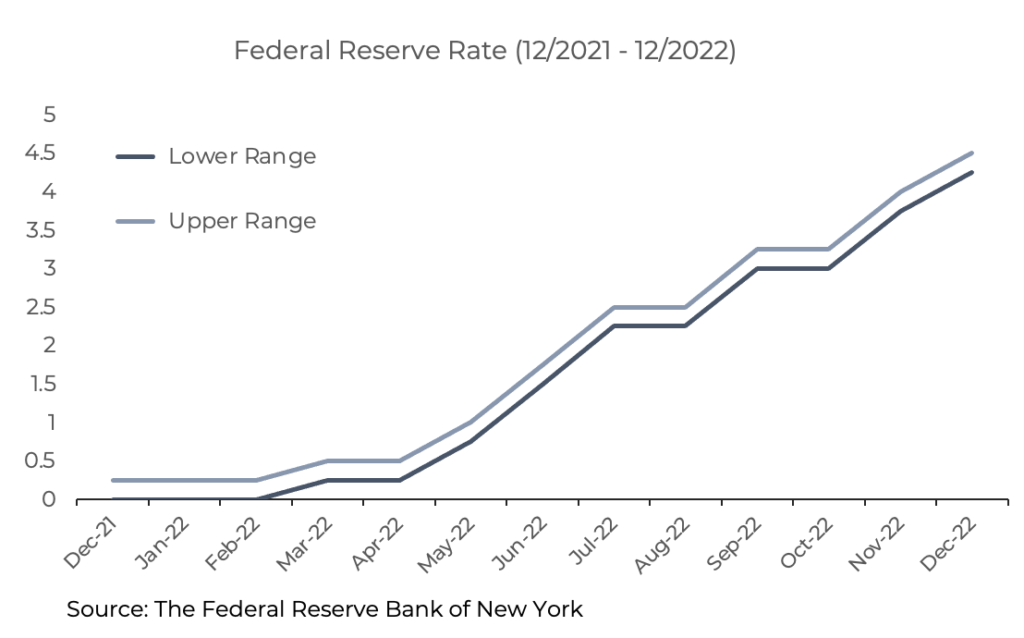

The monetary response to the Covid 19 pandemic helped the economy avoid a recession and perhaps a depression. However, the Federal Reserve was tardy in reining in the fiscal policy once the effects of the pandemic shutdown subsided. For much of 2021, we were told that inflation was transitory and would fix itself even though most economists were warning otherwise. This proved to be largely untrue which forced the Fed to pivot from dovish monetary policy to hawkish monetary policy in early 2022. Over the course of the last year, the Federal Reserve has raised interest rates 5 times for a total of 3.5%.

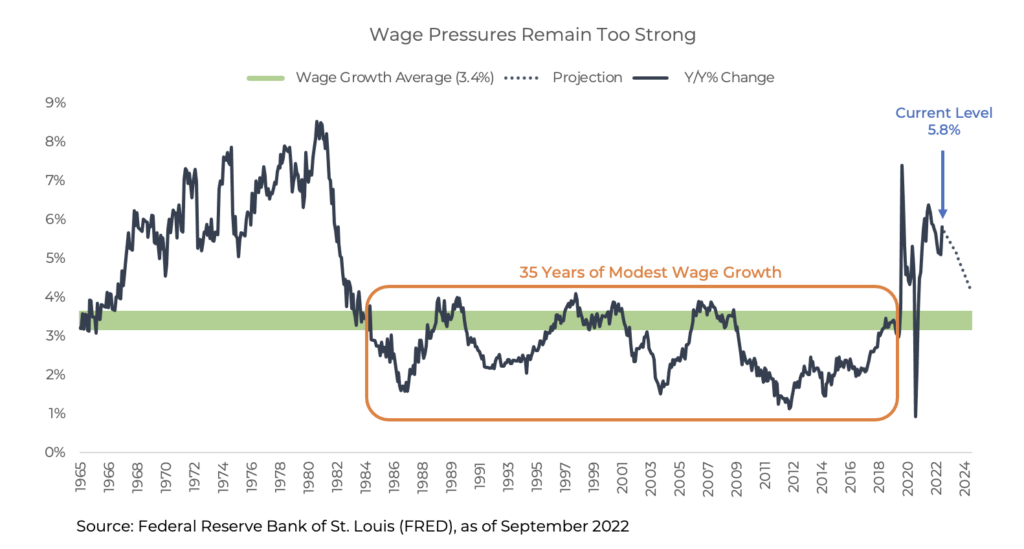

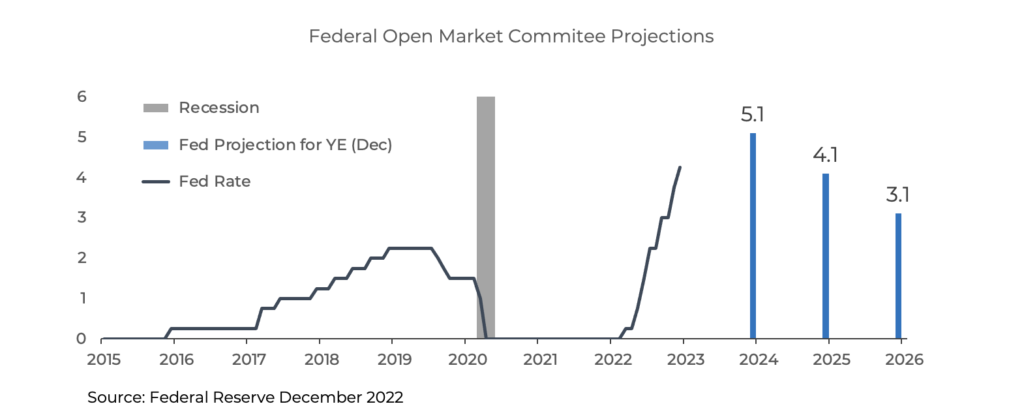

Guidance from the Federal Reserve indicates that controlling inflation is their number one priority and will continue to raise rates until inflation gets back to the targeted 2% range. Higher interest rates generally mean slower growth which is the catalyst to reducing inflation. Although geopolitical risk is always a concern, this is the number one thing behind the market volatility in 2022 and will likely be the key driver of market volatility in 2023. According to the Federal Reserve, the terminal interest rate is expected to be 5.1% which will be reached in 2023. Further guidance from the Federal Reserve indicates that they expect to reduce interest rates 1% in 2024 and 2025.

We do not believe it will be as simple as the Federal Reserve is forecasting. Unlike traditional rate tightening cycles, most of the inflation is coming from global supply chain disruptions within a backdrop of a strong US economy. China, the world’s second largest economy, is still pursuing a zero Covid policy. This disrupts, thus increasing the price, the goods that are imported. In addition, the war in Ukraine continues to disrupt food and energy supplies. Raising interest rates will not change either issue. However, it will disrupt one of the strongest job markets in the history of the United States. This will help decrease inflation, but the economic cost is likely to be higher than the gain.

This will force the Federal Reserve to make a critical decision: push the economy into a recession or accept higher rates for longer. The economy and market don’t need low interest rates to grow but it does require jobs. Which monetary path chosen will make a key difference in when the recovery starts.

Economy

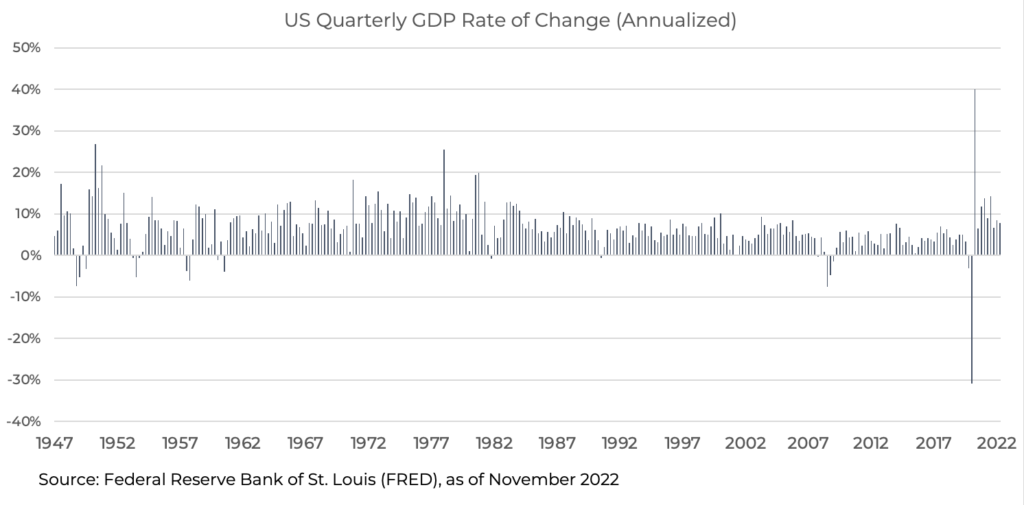

The underlying strength in the US economy has helped brace the markets from further losses due to the change in monetary policy. Consumer spending and business investment spending have continued to remain high throughout 2022. Although we experienced negative GDP in the first and second quarter, most of that can be attributed to China’s zero Covid policy and the US goods trade deficit which hit a record high in March. A decrease in government spending also added to the negative number. As these two contributing factors declined, GDP growth swung to the positive in the third quarter.

The strong annual consumer spending and business investment spending has boosted the labor market.

In all recessions that we’ve experienced or studied, three things almost always exist. There are no jobs, consumers/businesses aren’t spending money, and businesses aren’t making any money. None of that currently exists. In recent polls, most Americans feel like we are in recession. I’d suggest that is based on the decline in the stock market which is not indicative of what is happening in the economy.

Portfolio Implications

There have been very few investments safe havens in 2022. The S&P 500 and Nasdaq are down 16% and 26% respectively this year. Although it isn’t fun to be a part of, this level of volatility is more normal than not and relatively minor from a historic perspective. I believe that inflation and historic loss in the bond market is what has made this feel much worse than it normally does. The rapid pace of interest rate increases has caused bond prices to fall substantially. The YTD performance of aggregate bonds is the worst on record. It is exceedingly rare for stock and bonds to both post negative double digit returns in the same year. Generally, bonds decrease the volatility of a portfolio and dampen a portfolio’s losses.

A Bumpy Road Ahead

It is important to remember that the stock market is a leading indicator. It generally goes down before the economic data says it should and goes up before the economic data says it should. I suggest we are experiencing the former as opposed to the latter. The decrease in the market is not justified by the current economic data, rather the market is forecasting a Federal Reserve induced recession and the drop in corporate earnings that accompany it. However, the underlying strength of the US economy from well capitalized banks, healthy corporate financials, and a strong jobs market should mitigate a major recession such as we experienced in 2008. If these assumptions are correct, we are closer to the bottom than the beginning. In the short term, additional volatility and downside is possible and should be expected. However, this is the reset we wanted in our much-scorned research publication in late 2021, “Why We Want a Market Correction and You Should To”. The volatility throughout 2022 and likely the first half of 2023 is the foundation for healthy growth going forward. How quickly that path emerges will be determined almost entirely on whether the Federal Reserve can orchestrate a soft landing or induces a recession.

Portfolio Positioning

Stocks

One of MBM’s core stock beliefs is growth at a reasonable price. This has kept us away from speculative stocks and helped protect against the downside in 2022. Rising interest rates decrease the net present value of growth stock’s minimal positive cash flow. Therefore, the stock price of speculative investments is negatively affected in a rising interest rate environment. As the Federal Reserve started their monetary policy pivot in February, we proactively shifted from a growth tilt to a neutral allocation as dividend paying stocks generally perform better in this type of environment. This a trend that is likely to continue for as long as the Federal Reserve remains hawkish. Our higher for longer belief does not dictate a rapid recovery in high-risk stocks. This environment is more indicative of a slow recovery in higher risk stocks like that of the tech crash of 2000 than the rapid recovery experienced in March of 2020. Therefore, we remain more focused on high quality companies than trying to dumpster dive high risk stocks.

Fixed Income

One of MBM’s core fixed income beliefs is that fixed income should only be held to satisfy capital needs so that stocks don’t have to be sold at a bad time since fixed income is an anchor to the portfolio’s long-term performance. Therefore, we have traditionally trended towards shorter term, higher credit quality exposure. This absorbed the initial interest rate shock in February, but we further decreased the duration and increased the credit quality of the portfolio almost immediately. Therefore, our bond strategies have not participated in most of the index’s decline in 2022. However, the rapid rise in rates has allowed us to return to our second core belief of holding individual bonds. In the previous 2 years, interest rates have been so low that there has been very little opportunity in the individual bond market. That has changed substantially in 2022. We are now purchasing short term investment grade bonds and short-term government bonds with a yield to maturity not seen in 15 years. This increases the downside protection and expected return. We are continually replacing the exchange traded funds with individual bonds and expect to continue to do so. This has been an intentionally slow process as the strategy gets stronger with every interest rate increase.

Keys to Success

2022 has been a challenging year and this looks to continue for part of 2023. Although an exact market bottom is impossible to predict, we believe we are closer to a recovery than a bottom. In the meantime, we are confident our core beliefs in equities and fixed income will provide great long-term performance if they are pursued with a dose of patience. Everyone at MBM appreciates that patience, dedication to fundamentals, and above all, your continued support.

Disclosures:

Please note – investing involves risk, and past performance is no guarantee of future results. Asset allocation does not ensure a profit or protect against a loss. This material is intended for illustrative purposes only and should not be construed as specific investment or tax advice.

Investment advisory services offered through MBM Wealth Consultants, LLC, a registered investment adviser. Registration does not imply a certain level of skill or training.