“Inflation is taxation without legislation.”

Milton Friedman

In March, Congress approved a $1.9 trillion COVID relief package which sent $1,400 payments to most Americans. This was in addition to the $2.2 trillion package that was approved in 2020 to help combat the economic burden from COVID-19. The fiscal stimulus has been truly historic in the size and speed and it appears to have minimized the economic impact of COVID-19; however, we expect higher inflation to be a consequence of this financed spending.

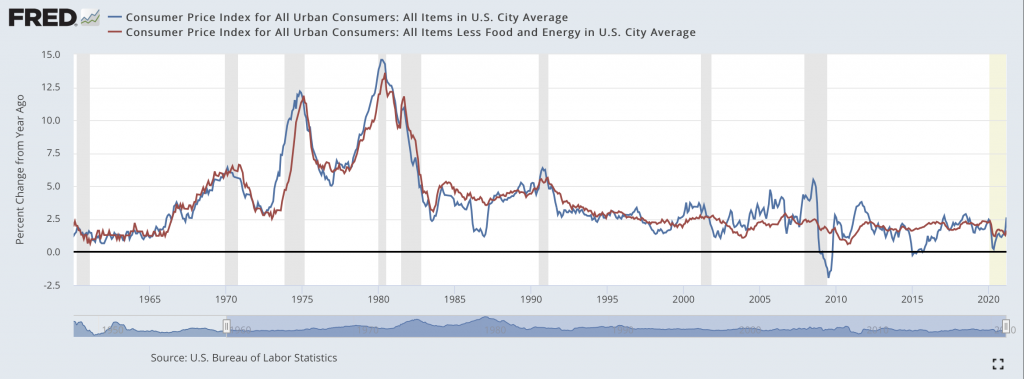

Recent inflation data does not support this theory. However, it is important to note the measurement of inflation by the Consumer Price Index (CPI) does not tell the whole story for the everyday consumer.

The current calculation of the CPI does not include food and energy, two items that are essential on a daily basis. As seen above, CPI swings are more volatile when it includes food and energy prices. Although recent data does not reflect inflation yet, we are skeptical of any calculation of the inflation burden an everyday consumer faces when basic human necessities are excluded. In the first quarter of 2021 alone, there are many commodity prices that have increased substantially but are not included in the CPI number.

- Lean hogs: up 54% YTD

- Gasoline RBOB: up 39% YTD

- Ethanol: up 33% YTD

- Canola: up 29% YTD

- Soybean oil: up 26% YTD

- Crude oil: up 23% YTD

- Corn: up 20% YTD

- Live cattle: up 9% YTD

Source: https://finviz.com/futures_performance.ashx?v=17

Inflation risk is something most investors have not had to contend with for quite some time. Although it is not as easy to see the effect it has on money as a market correction, it is a risk that will need to be considered going forward because it erodes the purchasing power of money. Instinctively, most people are aware that a dollar will not buy next year what it will buy today, but the sneaky compounding nature of purchasing power loss, overtime, would surprise most people.

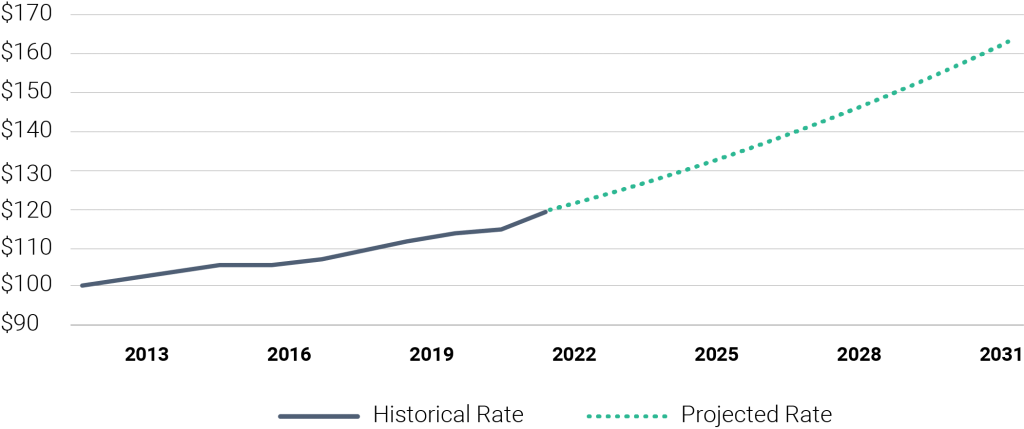

Price of goods using historic inflation (1.8% from 2011-21) and future inflation assumption (3.2% 2021-31)

In the graph above, the erosion of purchasing power from 2011-2021(blue line) resulted in about a 20% loss in the value of a dollar. However, this was during a period of historically low inflation. If inflation only returns to the historic average, the magnitude of the change in the price of goods almost doubles that from the previous 10 years (green line).

- 2011-2021: It would take $119,530 to purchase in 2021 what $100,000 would have purchased in 2011.

- 2021-2031: It would take $137,024 to purchase in 2031 what $100,000 would purchase in 2021.

Investors who have been holding a high level of cash have been spared by mild inflation over the last 10 years. We expect this to change going forward due to the inflationary pressure from historically large stimulus. Although it will never show up as a negative entry on your bank statement, it is a real loss, nonetheless. To combat increased inflationary pressure, investors will need to break the habit of keeping too much cash as a means of safety.

In conclusion, all investors need to have access to funds that can be accessed quickly. However, a liquidity plan that balances the risk of limited immediate liquidity with inflationary risk from too much liquidity should be a primary topic of conversation over the upcoming months.In May, we will discuss investing strategies for combating inflation, the likely response to increased inflation from the Federal Reserve and its investment implications, and what inflation means for stocks.

Citations:

https://www.cnbc.com/2021/03/08/1400-stimulus-checks-who-is-eligible-how-soon-they-could-arrive.html

https://www.investing.com/economic-calendar/core-cpi-736

https://fred.stlouisfed.org/graph/?g=rocU

https://smartasset.com/investing/inflation-calculator#6SVJBJVE99

http://www.moneychimp.com/features/market_cagr.htm

Please note – investing involves risk, and past performance is no guarantee of future results. Asset allocation does not ensure a profit or protect against a loss. This material is intended for illustrative purposes only and should not be construed as specific investment or tax advice.

Investment advisory services offered through MBM Wealth Consultants, LLC, a registered investment adviser. Registration does not imply a certain level of skill or training.