“Volatility is price of admission. The prize inside is superior long-term returns. You have to pay the price to get the returns.” – Morgan Housel

After a relatively calm equity market environment since 2022, the U.S. stock market has shown signs of stress to begin 2025. Market stress can be described as volatility (the amount the market is moving around) or drawdown (the amount the market has declined from a previous level). Unfortunately, both have made their presence known to kick off the year. The biggest contributing factors are:

- Threat of tariffs: The new administration has proposed tariffs (taxes on imported goods) on a variety of products and a variety of trading partners, notably Mexico, Canada, and China. As of this writing, a sizable portion of the tariffs are scheduled to go into effect in early April. The magnitude of the proposed tariffs and the speed at which the proposals change have created uncertainty for businesses and consumers, and the stock market dislikes uncertainty. Though few businesses have cited recession concerns on recent earnings calls, tariff concerns have contributed to lower guidance for near-term earnings.

- Fiscal focus: The new administration has focused on reducing the federal budget deficit through a variety of avenues, including reducing the number of government employees, cutting federal spending, and identifying & reducing instances of fraud and abuse of government payments. While most would agree fiscal responsibility is positive, the pace at which the administration has begun to implement changes and the uncertainty of the final outcomes has contributed to trepidation in the market.

- Market valuation: The S&P 500 index was near its historical high price-to-earnings ratio entering 2025. Valuation is a terrible predictor of short-term returns, however a higher valuation means the market has less room for error which can amplify market movements to the downside when hiccups occur.

- Wealth effect: The strong stock market returns in 2023 & 2024 have helped buoy consumer spending which has been a large contributor to U.S. economy. If a significant market decline occurs, it could have a corresponding effect on consumer confidence and future spending. This possibility has also weighed on the market.

- Other/seasonal effects: Historically, the third year of a bull market, the first year of a new presidential administration, and the first few months of the year after a strong equity market year have been weaker periods for U.S. stock market returns.

Regardless of the reason for market turbulence or how quickly it happens, it is not fun for investors. As of the date of this writing, the S&P 500 has approached correction territory, with a drawdown of close to 10% since the highs in mid-February. However, stock market corrections in and of themselves are not reasons to abandon ship. Here are helpful points to remember:

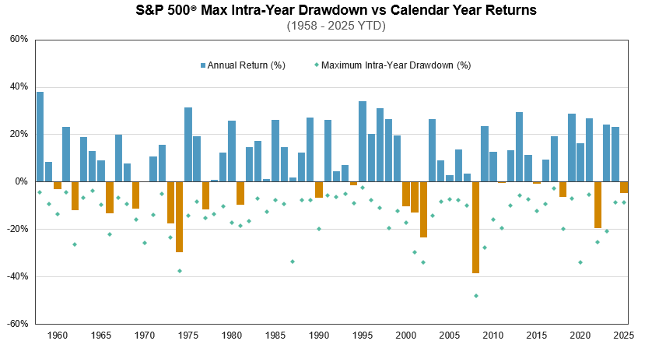

- Drawdowns of the current magnitude are common. Calendar years with strong returns even experience their share of market stress. Over the past 40 years, the median intra-year maximum drawdown for the S&P 500 index is approximately 10% (see Chart 1).

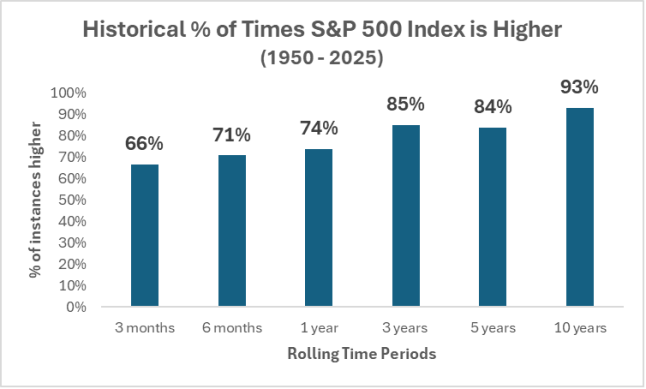

- Historically, the odds have been in favor of investors. As an example, over rolling daily time periods since 1950, the S&P 500 index has been higher 74% of the time 1-year later and 85% of the time 3-years later after a 10% correction (see Chart 2).

- The best and worst days in the stock market tend to cluster together, making the task of perfectly timing the market on a day-to-day basis or predicting exactly where the market will go after a correction difficult.

Chart 1

Chart 2

Market volatility is like turbulence in an airplane. Turbulence is a comfort issue for the passengers, not a safety issue for the airplane. Pilots know light turbulence will happen from time to time and it does not alter the flight plan. In times like these, it helps to channel your inner pilot knowing turbulence is normal and the best course is to focus on the end goal. Volatility feels uncomfortable but is not a “safety” issue nor a reason to dramatically alter a long-term well-constructed financial portfolio & plan. As a firm, we focus on plan based investing. Volatility is one of the key metrics accounted for in your financial plan. The seat belt light may be on, but calmer skies are always on the horizon.

From all of us at MBM, we are grateful for your continued trust and support.