“What lies behind you and what lies in front of you, pales in comparison to what lies inside of you,” Ralph Waldo Emerson.

Clearly Mr. Emerson hasn’t lived through the first half of 2020. The market correction experienced in the first quarter was the fastest 30% drop in the history of the S&P 500. In short order, the S&P rebounded to have the best 50-day rally ever. This has left many investors feeling whipsawed and unsure of what to do or believe. It doesn’t help that COVID-19 seems to be a bottomless pit of complexity, contradictory data, and guesswork confounding the best medical professionals in the world. How it affects the economy is the same — complex and without precedent. We have a range of short-term possibilities forecasted, but the confidence level in each is low because it depends on the evolution of the pandemic and a new virus in which the scientific community is still trying to understand. Instead of chasing a shifting and unpredictable landscape, we continue to identify long-term trends that will benefit the patient investor.

In a rather unclear world, we thought it would be helpful to provide insight into some of our thoughts.

Lesson #1: Don’t Fight the Federal Reserve but Prepare for Higher Taxes.

The economic shutdown successfully flattened the curve when very little was known about the virus. However, the economic implications of doing so were disastrous. It caused the global economy to go into a recession that will likely be the worst experienced during modern economics. The Organisation for Economic Co-Operation and Development believes the world economy will contract by 6% in 2020.1 Absent a vaccine or another required shut down, a recovery to pre-virus levels may take another 18-24 months. However, the damage to the United States and other world economies was reduced with quick fiscal and monetary stimulus.

As of June 26th, the United States’ national debt is $26.3 trillion dollars or $79,597 per citizen.2 This is a scary number and almost certainly means taxes will increase from their historically low levels. Increased tax rates to pay the national debt will slow economic growth for the foreseeable future once the situation is addressed. However, the stimulus packages which helped the markets rebound quickly do not necessarily mean the stock market is a house of cards. Many investors learned that lesson the hard way between March of 2009 through 2013. During that period, the S&P 500 increased approximately 102% during a period where the economy/market would not have grown at the pace it did without the 4 rounds of quantitative easing.3 We expect significant volatility over the next couple of years but ultimately believe April of 2020 will be the start of a new bull market on the back of record economic stimulus. It may take some time for the economy to get back to where it was before the pandemic, but the market will ride the stimulus packages until it does. This assumes a second wave of the virus doesn’t force another economic shutdown. This would certainly bring back the fear of entering the Great Depression II which we believe policymakers will factor into the decision. The number of people infected with COVID-19 will increase but our health care system is better equipped to handle this than it was in March, lowering the risk of another shutdown.

Lesson #2: Invest Domestically

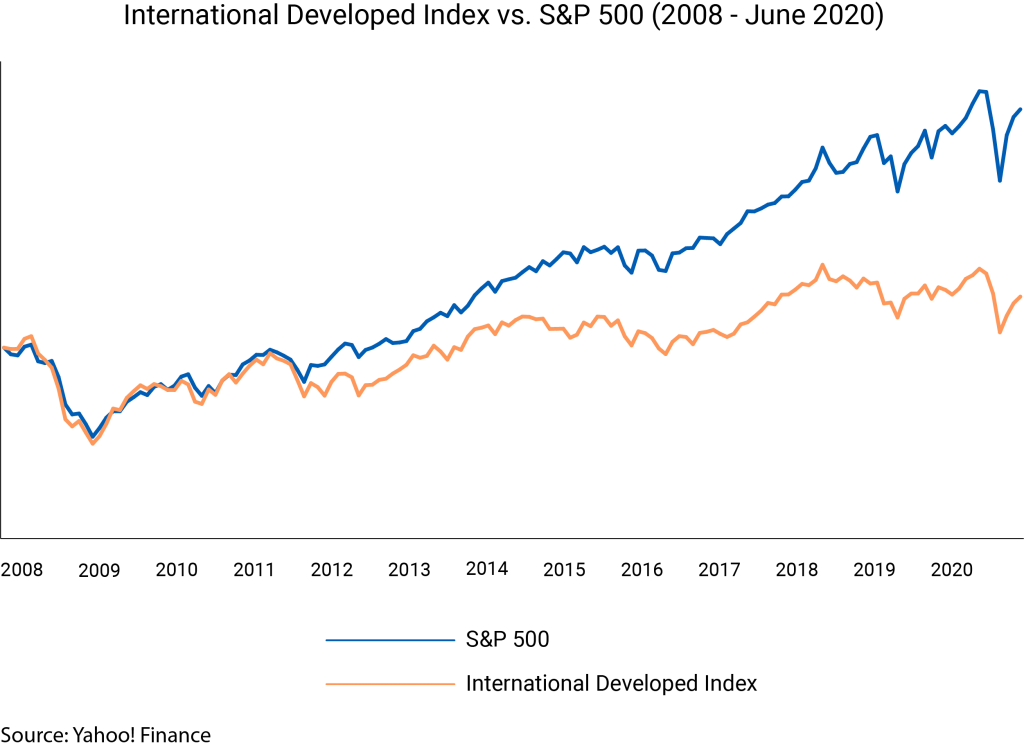

For years, MBM’s Investment Committee has been wary of the risk/reward tradeoff in international investments. We have kept the portfolios tactically underweight this investment category because the fundamental issues exposed during the Great Recession were never addressed. These fundamental issues are once again rearing their head. Unlike the United States, European countries cannot coordinate monetary and fiscal stimulus because they do not operate under a single government. The European Central Bank implements economic and monetary policy, but the financial condition of its member countries is remarkably different. This limits their collective ability to coordinate a response as aggressive as what the United States did after the Great Recession and what is being done during this pandemic. This lack of coordination led to a slower recovery after 2008 and will likely result in a slower recovery after 2020. The potential economic decline in the Eurozone could be as much as double that of the United States.4

Unlike developed international markets, valuations in some emerging market regions are attractive. Emerging markets dropped significantly during the last bear market that began in 2007 but provided a far bigger rebound than developed international markets. We would expect this scenario to repeat itself, especially in Latin America. It is important to note that emerging markets can be exceptionally volatile and highly correlated to all equity prices during periods of high volatility or fear. This investment theme could take years to be fully realized but should reward the patient investor with above-average returns.

Lesson #3: Don’t Try and Time the Markets

There are many factors that could quickly erase the current market recovery and most people have never lived in a period where the future was so uncertain. With uncertainty at an all-time high and the markets within 10% of where they started the year, it is natural to ask if money should be taken out of the market. This is a hot topic among investors because of the emotional toll of the last four months. Although the flight to safety may feel good, nine decades of market data suggest it won’t end well.

At its very core, the debate is whether an investor is better off trying to time the market or manage a strategic allocation based on their specific goals, time horizon, and risk tolerance. For comparison, it is assumed that each investor starts with a portfolio of 60% S&P 500 and 40% 5-Year Treasury Notes. The strategic allocation was rebalanced to 60/40 when the equity allocation reached 66% or fell to 54%. The market timer went from 60/40 to 0/100 when a correction was anticipated. The portfolio was moved back to 60/40 at the market bottom. Over nine decades, a market timer would have outperformed by 2.2% per year if the exact market top and the exact market bottom was timed perfectly.5 If either the top or bottom was missed by just a little, a strategic allocation held the upper hand in virtually all scenarios. The market is a leading indicator which means a correction starts before the economic data says it should and a recovery starts long before economic data confirms it. The gamble to attempt perfect timing through both sides of a correction and recovery over 9 decades and roughly 16 bear markets for an annualized 2.2% is not one our investment committee is comfortable making. It only takes one large misstep (on either the buy or sell side) to derail the long-term performance of a portfolio forever.

No one likes to lose money and it generally happens during times when other aspects of life are uncertain, but investment losses are a natural and necessary part of investing. If the potential for a loss wasn’t prevalent, the long-term return of stocks would not be available. At MBM Wealth Consultants, every investor’s portfolio is customized to accommodate their capital needs, time horizon, and risk tolerance. Our goal is to keep enough safety in each portfolio to satisfy 5-7 years of capital needs to prevent a forced sale of an investment during an inopportune time.

The first part of 2020 is one I think most of us would like to forget and are eager to move past. It has challenged everyone with previously unthought of issues and appears that it will continue to do so for the foreseeable future.

During these challenging times, we appreciate the continued trust and will keep providing relevant communication along the way. If you have questions about your specific situation, please reach out to your lead communicator. Feel free to share this with family and friends as we are actively accepting new clients.

- How is the global economy fairing? Yahoo! Finance, June 2020

- www.usdebtclock.org

- The Virus, The Economy, and The Market – Jeremy Grantham, GMO Quarterly Letter 1Q 2020

- Uncertainty Has Seldom Been Higher – Ben Inker, GMO Quarterly Letter 1Q 2020

- Does Market Timing Work? – Ashvin Viswanathan, Real Assets Advisor June 2020