“There are three things I have learned never to discuss with people…religion, politics, and the Great Pumpkin.”

Linus from “It’s the Great Pumpkin, Charlie Brown”, 1966®

Although Linus made this line famous, the age-old advice of not discussing religion and politics dates back to the 1800’s. However, with a polarizing view of the 2020 election less than 2 months away, the MBM Investment Committee has been dragged into discussing politics because the effect of the election on the stock market has been the number one question we’ve fielded over the last two months. It’s worth noting that this research paper is relevant for Republicans, Democrats, Liberals, and Conservatives alike as it does not dive into the diverse opinions of the members of the Committee.

The heightened emotional state of the nation is playing directly into the media narrative of selling election coverage. It is a wonderful sales opportunity that only occurs every four years. With the amount of coverage and story catching headlines, there is no wonder the vast majority of investors (93%) believe the presidential race will affect the stock market.1 In addition, the desired policy guidelines of President Donald Trump and presidential hopeful Joe Biden are widely different. The popular feeling is that President Trump will continue economic and market growth through low taxes and decreased regulation whereas Joe Biden’s desire for increased taxation and regulation will stifle economic growth. In order to keep investors from bringing emotion into investing, the Committee explored nearly 186 years of data for insight into an action plan regardless of the outcome of the next election.

Trump Victory, Republicans Hold the Senate, Democrats Retain the House

From a market standpoint, this is likely the best-case scenario because it eliminates uncertainty for the next 4 years. The pro-business policies through decreased regulation and lower taxes should propel the market to further gains. Foreign trade tensions will mute some of the potential gain.

According to Hightower Advisors, a 3-5% immediate market increase is likely.2

Biden Victory, Democrats Take the Senate and Retain the House

The initial reaction from Wall Street would be negative because of the increased uncertainty around tax reform and increased regulation. However, we believe tax reform that raises tax rates will be highly unlikely over the next couple of years as the nation and international economy recovers from the pandemic. After a shock sell off, the increased certainty over foreign trade and another round of economic stimulus would likely erase the initial losses.

When there is a Blue Sweep, the stock market has fallen 60% of the time in November but is positive 100% of the time in December.3 Although Wall Street worries about a Democratic sweep, the market’s frequency of advance was the highest when this scenario occurs.

Biden Wins, Republicans Hold the Senate, Democrats Remain Control of the House

The gridlock of this scenario is also market friendly as very little would likely be changed. In addition to keeping a favorable tax and deregulation environment, the uncertainty of Trump’s negotiating style would be removed. A 3-5% immediate gain is probable.4

Unknown Election Results

20 years ago, it took five long weeks to determine the winner of the George Bush and Al Gore election. During this time, the S&P 500 fell 10% and the Nasdaq fell almost 20% as investors tried to position their portfolios accordingly.5

Goldman Sachs’ chief US equity strategist, David Kostin, predicts this would be the worst-case scenario.6 Volatility would most likely spike due to emotional investing decisions. However, this would give long term investors that have the ability to ignore emotion the opportunity to capitalize on short term volatility.

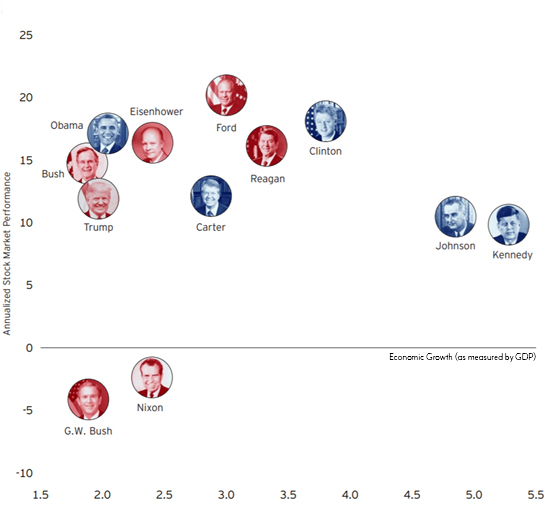

You may feel strongly about one party or the other when it comes to your personal beliefs, but when it comes to your portfolio, the conventional wisdom of Republican economic and market dominance because of business-friendly politics isn’t based on evidence. Over the last 120 years, market returns have shown very little difference in whether there was a Republican or Democratic president. The economy and businesses adapt to changes remarkably quickly.

Presidential Term Stock Market Return vs. Economic Growth (1957-Present)

Once again, we’d like to caution against the belief that this time is different. That is one of the most dangerous and expensive phrases in investing as history tends to repeat itself over and over. Market volatility is expected to increase over the next couple of months and it will be tempting to try and guess the direction of the market; however, market timing rarely works out as it requires investors to make two correct decisions: when to get out and when to get back in. Being incorrect on either will cause unrepairable long-term damage to the portfolio. An investor that holds a diversified portfolio that is fundamentally sound and risk appropriate will outperform an investor that attempts to gamble on potential changes from the upcoming election. In addition to being impossible to predict (remember that Clinton was supposed to win in a landslide), the factors that drive the economy and stock market extend well beyond who is elected the next president of the United States.

However, the path proposed by Donald Trump and Joe Biden is remarkably different. Although we believe the effect on the overall stock market will be minor, regardless of who wins, there are several things investors should consider over the next two months. Our October commentary will focus on the tax planning and tactical portfolio shifts that should be considered based on the outcome of the November elections.

- Konish, Lorie. (9/11/20). Trump vs. Biden. Retrieved from: https://www.cnbc.com/2020/09/11/trump-vs-biden-how-the-election-may-influence-your-stock-investments.html,

- Klebnikov, Sergei. (9/10/20). A Biden Victory And Split Congress Is Best For Stocks, But Here’s What Would Kill Markets After Election Night. Retrieved from: https://www.forbes.com/sites/sergeiklebnikov/2020/09/10/a-biden-victory-and-split-congress-is-best-for-stocks-but-heres-what-would-kill-markets-after-election-night/#67f6a82124dd

- Klebnikov, Sergei. (9/10/20). A Biden Victory And Split Congress Is Best For Stocks, But Here’s What Would Kill Markets After Election Night. Retrieved from: https://www.forbes.com/sites/sergeiklebnikov/2020/09/10/a-biden-victory-and-split-congress-is-best-for-stocks-but-heres-what-would-kill-markets-after-election-night/#67f6a82124dd

- Klebnikov, Sergei. (9/10/20). A Biden Victory And Split Congress Is Best For Stocks, But Here’s What Would Kill Markets After Election Night. Retrieved from: https://www.forbes.com/sites/sergeiklebnikov/2020/09/10/a-biden-victory-and-split-congress-is-best-for-stocks-but-heres-what-would-kill-markets-after-election-night/#67f6a82124dd

- Klebnikov, Sergei. (9/10/20). A Biden Victory And Split Congress Is Best For Stocks, But Here’s What Would Kill Markets After Election Night. Retrieved from: https://www.forbes.com/sites/sergeiklebnikov/2020/09/10/a-biden-victory-and-split-congress-is-best-for-stocks-but-heres-what-would-kill-markets-after-election-night/#67f6a82124dd

- Stevens, Pippa. (7/8/20). Goldman warns delayed election results this November similar to Bush-Gore could rock the market. Retrieved from: https://www.cnbc.com/2020/07/08/goldman-warns-delayed-election-results-this-november-similar-to-bush-gore-could-rock-the-market.html

Please note – investing involves risk, and past performance is no guarantee of future results. Asset allocation does not ensure a profit or protect against a loss. This material is intended for illustrative purposes only and should not be construed as specific investment or tax advice.

Investment advisory services offered through MBM Wealth Consultants, LLC, a registered investment adviser. Registration does not imply a certain level of skill or training.