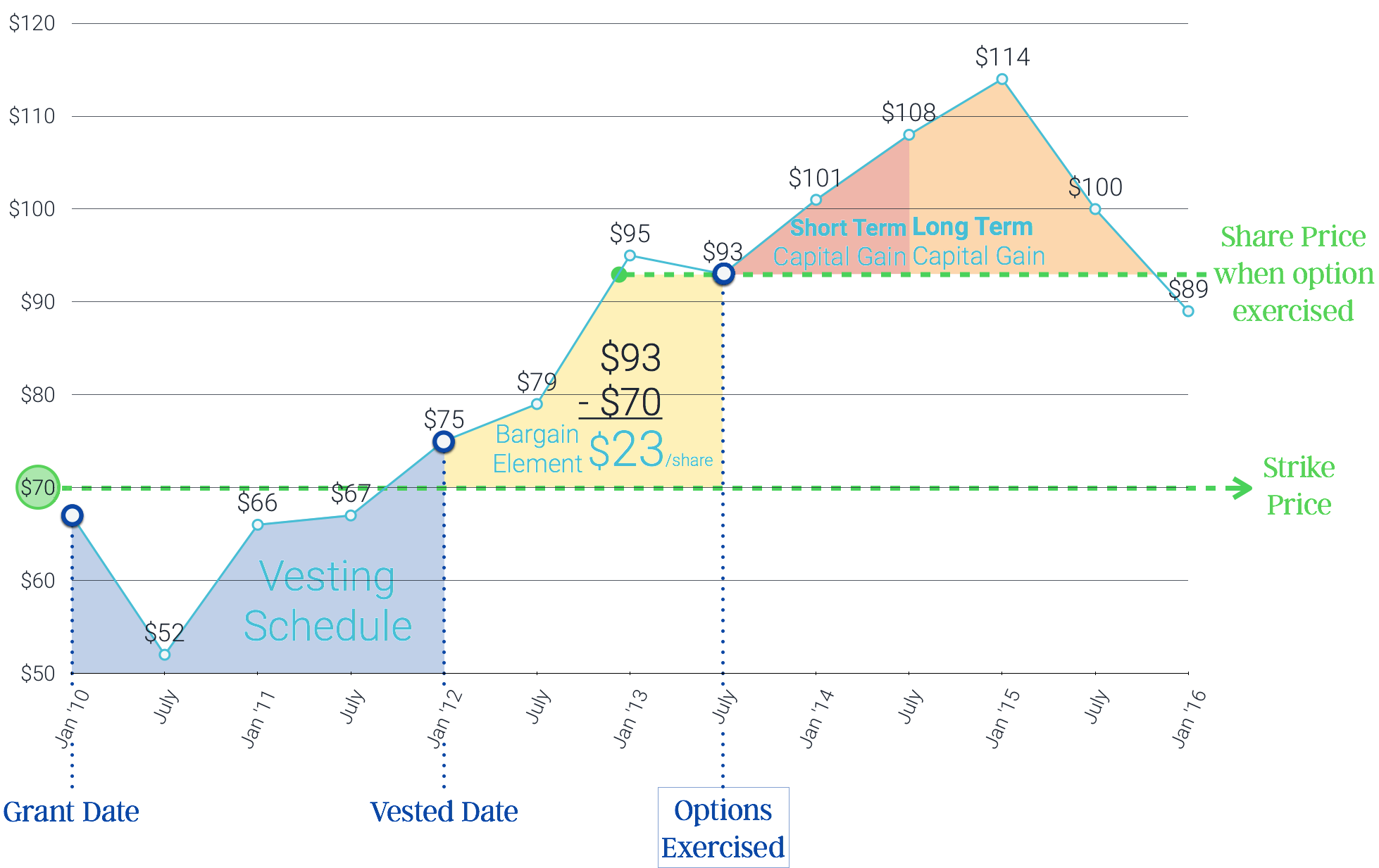

Stock options can be an excellent addition to a compensation package from your employer and, when used appropriately, can accelerate your trip on your road to retirement. The confusion begins when the options vest and you are left alone to decide how, and when, you will take advantage of your windfall.

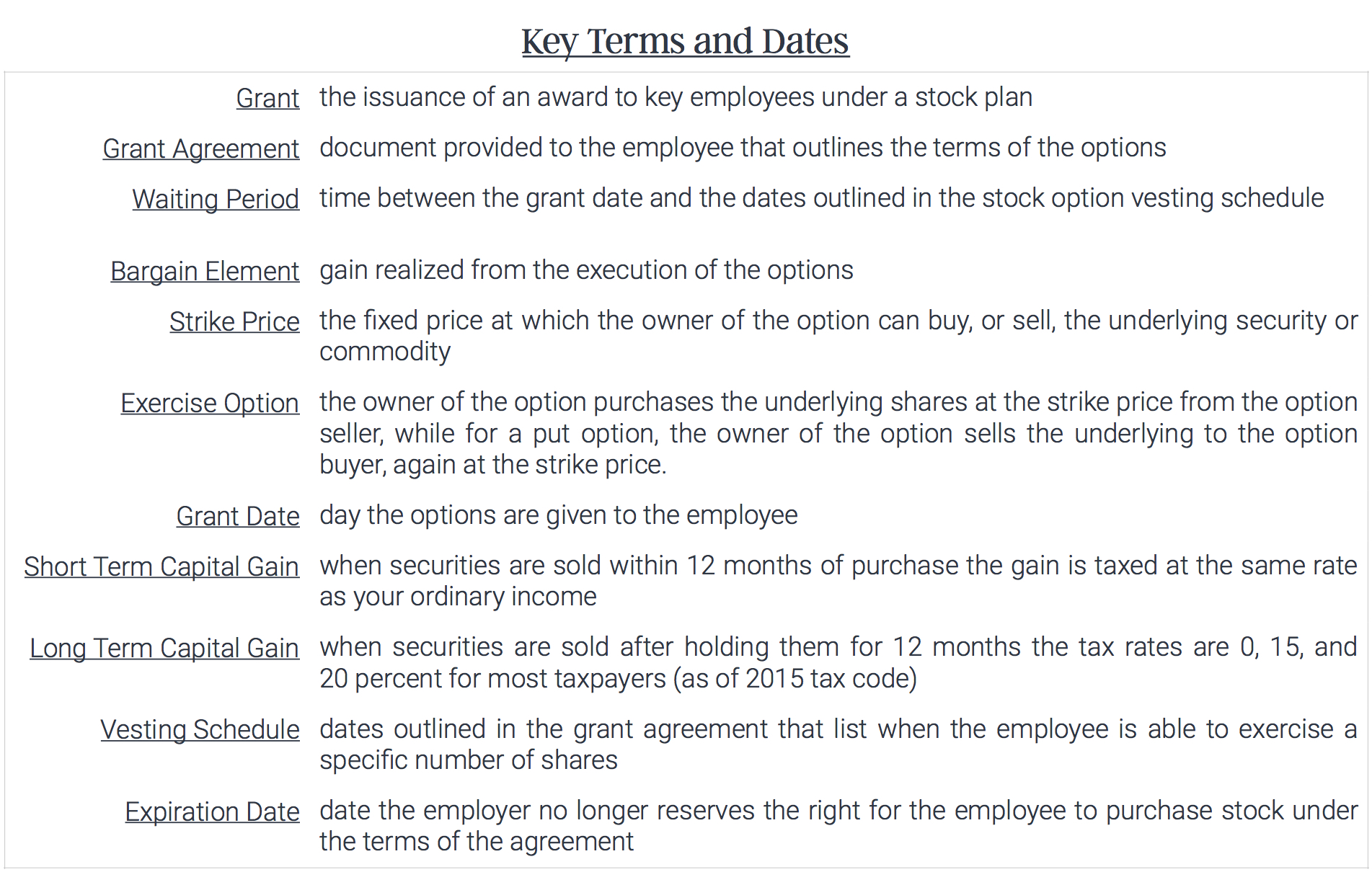

First, you’ll need to familiarize yourself with some terms surrounding stock options:

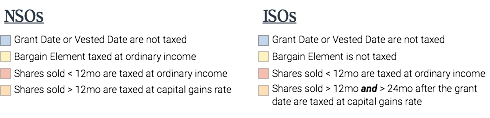

The two main types of stock options given to employees are Non-Qualified Stock Options (NSO) and Incentive Stock Options (ISO). Among other important information, the type of option you have will be outlined in the grant agreement given to you by your employer. Though the grant of both NSOs and ISOs isn’t a taxable event, the decisions you make after that point vary depending on which type you have:

In some circumstances the vesting schedule can be accelerated due to the occurrence of a specific event. The two reasons you might be facing an accelerated vesting schedule is a sale or merger of the company (change of control) and/or a termination for something other than “cause” (involuntary termination). You can find your company’s definitions and acceleration schedule for either of these events in the grant agreement.

There are several important considerations to make when choosing to exercise the vested portion of your options.

Timing

When considering the execution of your options, it can be difficult to have certainty on the timing. The most important thing you can do is make a plan and stick to it. No second guessing. No whimsical decision making. No flying by the seat of your pants. Multiple strategies can be implemented but the two main choices are:

- choosing certain dates to execute the options to spread the taxable liability over multiple years

- choosing prices at which you will be willing to execute a specific portion of your options contracts

Because options have a expiration date, it’s critical that you align your strategy to exercise your options before you’re forced to for fear of losing them all together.

Asset Allocation

Once your options are executed it’s important to have an idea what you want to do with the new shares you own in your company. The execution of stock options could have a profound effect on your overall asset allocation. And like most aspects of personal finance, it’s important to approach this issue with a plan.

The unofficial rule of financial advising is to never have more than 20% of a portfolio in a single company’s stock. While that may seem reasonable to some, keep in mind you have to be willing to put 1 out of 5 dollars in your entire financial strategy in the hands of a single company. If you want to maintain 20%, or more, of your portfolio in one company here’s a few reasons why that may not be a good idea:

- Enron

- WorldCom (MCI)

- Lehman Brothers

- American Insurance Group (AIG)

- PanAm, TWA, actually…just go ahead and pick an airline other than Southwest

There’s plenty of historical references to be cautious about having too much in one place.